In a landmark move, Republican leaders in the U.S. House of Representatives have declared July 14–18 as “Crypto Week,” during which they plan to consider three major cryptocurrency bills: the CLARITY Act, the GENIUS Act, and the Anti-CBDC Surveillance State Act.

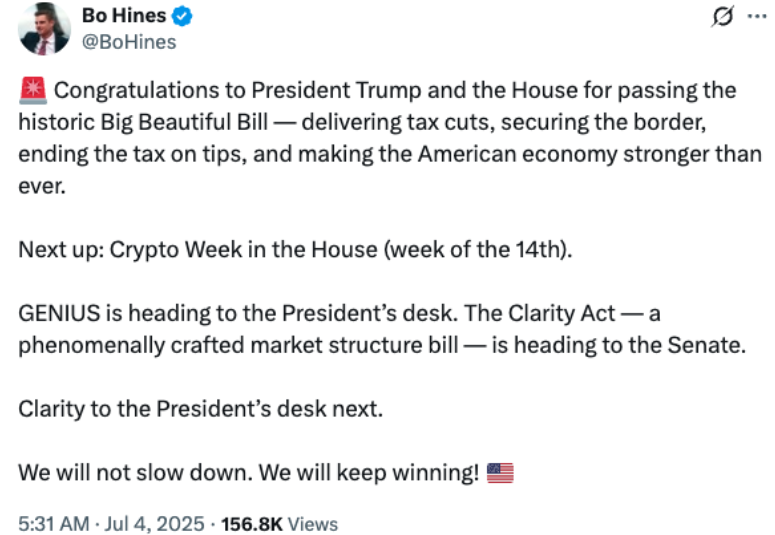

This coordinated legislative effort aims to fast-track the crypto agenda of President Donald Trump, who has called for swift regulatory clarity and protection of digital asset innovation in the U.S.

1. GENIUS Act: Stablecoin Regulation in Focus

The GENIUS Act, which passed the Senate with bipartisan support in June, will take center stage during Crypto Week. It outlines a comprehensive regulatory framework for stablecoins, allowing state-level oversight for eligible issuers—a key difference from the more stringent House-led STABLE Act.

President Trump has personally urged Congress to pass the GENIUS Act before the August recess, signaling its political and economic importance. If passed by the House without amendments, the bill would go straight to the President’s desk.

However, legal experts from Pillsbury Law and Troutman Pepper warn that the House could propose revisions to sections covering issuer eligibility and federal-state oversight, potentially sending the bill back to the Senate for reconciliation.

2. CLARITY Act: Defining Crypto Market Structure

Another key proposal is the CLARITY Act, designed to establish a clear crypto market structure by defining regulatory boundaries between the SEC (Securities and Exchange Commission) and the CFTC (Commodity Futures Trading Commission).

Key provisions include:

- Requiring crypto exchanges to register with the CFTC

- Rules for customer asset segregation and disclosures

- Clarifying whether tokens are securities or commodities

Advanced by the House Financial Services and Agriculture Committees on June 10, the bill still awaits Senate approval. Bo Hines, a top crypto policy advisor at the White House, expects the CLARITY Act to swiftly pass the House.

3. Anti-CBDC Surveillance State Act: Blocking a Digital Dollar

The third bill under discussion aims to ban the development or issuance of a U.S. Central Bank Digital Currency (CBDC). The Anti-CBDC Surveillance State Act would restrict the Federal Reserve from creating or offering any digital dollar directly to consumers.

This legislation reflects rising concerns among Republicans that a CBDC could infringe on privacy and potentially lead to government overreach into individual financial activity.

Introduced again by House Majority Whip Tom Emmer, the bill passed the House Finance Committee in April. Its Senate companion is still in committee.

Crypto Lobby Watching Closely

These bills are seen as central to Trump’s broader pro-crypto platform, which has drawn major backing from the digital assets industry. From tax reform to stablecoin infrastructure, Republicans are positioning themselves as crypto-forward lawmakers ahead of the 2026 midterms.

Meanwhile, Democrats remain skeptical, pointing to growing concerns over conflicts of interest tied to Trump’s family-linked crypto ventures.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.