The US Senate has taken a significant step toward reshaping crypto regulation, as lawmakers began the formal markup of a long-awaited crypto market structure bill. The session marks a critical moment in Congress’ effort to move away from enforcement-driven oversight and toward a clear statutory framework for digital asset markets.

The proposal, developed over several months, aims to define regulatory responsibilities for cryptocurrencies, trading platforms, and intermediaries. Debate during the markup highlighted lingering divisions over ethics provisions, regulatory authority, and market oversight, signaling that negotiations are far from settled.

Sen. Cory Booker, D-NJ cited work done between Republicans and Democrats on the committee over the past few months, including a bipartisan discussion draft released in November, though the situation shifted after the holidays, he said.

“But then I come back to Washington and start the year with the news that my Republican colleagues were walking away from the bipartisan process that produced the draft,” Booker said .

Committee Vote Advances Bill Toward Full Senate

Following deliberations, the Senate Agriculture Committee voted 12–11 to advance the bill, with several amendments rejected along party lines. Lawmakers emphasized that the text must still be merged with parallel legislation from the Senate Banking Committee before reaching a full floor vote.

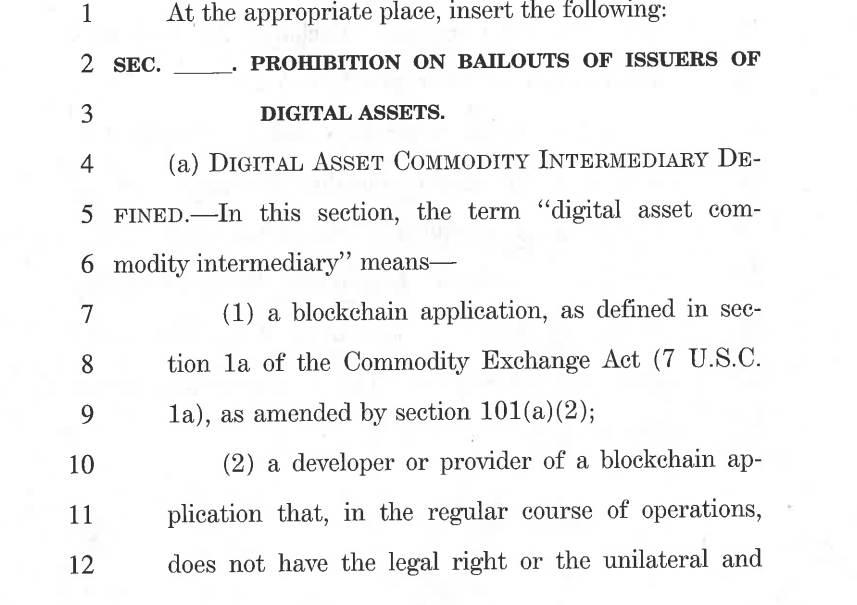

Key amendments related to crypto bailouts and ethics restrictions were voted down, with supporters arguing such measures were necessary to prevent conflicts of interest, while opponents said existing safeguards were sufficient.

Oversight, Innovation, and Regulatory Balance

Democratic senators raised concerns about concentrated authority at the Commodity Futures Trading Commission (CFTC) and the lack of explicit ethics rules. Others stressed the importance of protecting self-custody and software developers, warning against criminalizing code or innovation.

As discussions continue, the markup signals growing urgency in Washington to establish comprehensive and predictable rules for the US crypto market, even as bipartisan consensus remains a challenge.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.