Market Enters Cooling Phase Amid Institutional Pause

The impressive 15-day net inflow streak for U.S. spot Bitcoin ETFs has officially ended, as the funds experienced $342.2 million in net outflows on Tuesday, July 2, 2025, marking a significant shift in short-term market sentiment.

This outflow follows a robust $4.7 billion cumulative inflow over the past two weeks — a streak that had fueled Bitcoin’s recent momentum and drove optimism across institutional and retail investor segments.

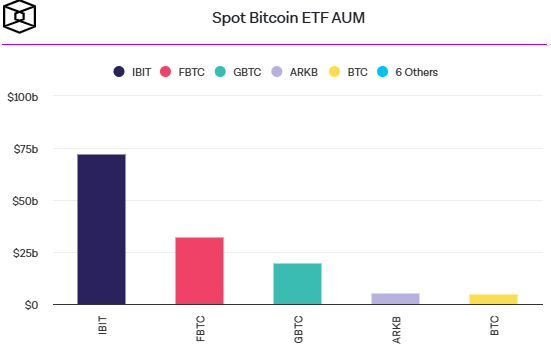

BlackRock’s IBIT Sees No Flows, Fidelity Leads Outflows

One of the most surprising data points was BlackRock’s IBIT, which posted zero flows for the day, ending its $3.8 billion inflow streak. While no outflows were recorded, the stall signals a momentary pause in institutional activity.

Fidelity’s FBTC led the exit wave with $172.7 million in outflows, followed by:

- Grayscale’s GBTC: $119.5 million

- Ark Invest’s ARKB: $27 million

- Bitwise’s BITB: $23 million

This sudden shift could indicate profit-taking, portfolio rebalancing, or a wait-and-see approach ahead of key macroeconomic data releases.

Cooling or Reversal? Analysts Weigh In

According to Valentin Fournier, Lead Research Analyst at BRN, the cooling of inflows was expected, especially as the pace slowed in recent sessions. He cautioned that while this isn’t necessarily a trend reversal, it does reflect a pause in short-term institutional accumulation.

“Bitcoin needs fresh catalysts to break above the $110,000 resistance,” Fournier noted.

Bitcoin Market Holds Steady

Despite ETF outflows, Bitcoin (BTC) has remained relatively resilient. After dipping below $105,500 early Wednesday, it rebounded to around $107,800, according to The Block’s data.

This consolidation phase, hovering between $105,000 and $110,000, is viewed by many analysts as a bullish structure, with shallow dips suggesting that buyers are still stepping in on weakness.

Vincent Liu, CIO of Kronos Research, explained that markets are currently in “a cooling consolidation period,” with liquidity low and traders awaiting key U.S. jobless claims data due July 3.

Ethereum ETFs Show Continued Strength

While Bitcoin ETFs saw net redemptions, U.S. spot Ethereum ETFs reported $40.7 million in net inflows on the same day. This marked the third consecutive day of ETH inflows, totaling $150 million during that span.

BlackRock’s ETHA fund led the charge with $54.8 million, suggesting growing institutional interest in Ethereum as a diversified crypto treasury asset.

To date, Ethereum ETFs have accumulated $4.3 billion in total net inflows, a notable feat considering they launched just one year ago.

Market Momentum Remains, But New Catalysts Needed

While the 15-day inflow streak ending is noteworthy, it doesn’t necessarily signal a bearish reversal. Instead, it reflects a natural market pause amid consolidation and upcoming economic catalysts. Bitcoin’s structure remains intact, and renewed institutional momentum — fueled by regulatory clarity, ETF expansions, or macro data — could reignite the next leg up.

Stay tuned as ETF flows, macro conditions, and crypto sentiment continue to shape the second half of 2025.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.