Payment giant expands blockchain settlement for U.S. banks amid regulatory shift

Visa has announced the launch of stablecoin settlement services in the United States, enabling financial institutions to settle payments using USDC on the Solana blockchain. The move highlights accelerating institutional adoption of blockchain-based payment infrastructure as demand grows for faster and programmable settlement systems.

Visa Enables USDC Settlement for U.S. Banks

Under the new initiative, U.S. banking partners can use Circle’s USDC for backend settlement flows over Solana’s high-speed, low-cost network. Early participants include Cross River Bank and Lead Bank, with broader expansion planned through 2026. Visa stated the service is designed to integrate with existing treasury and liquidity management systems, while maintaining enterprise-grade security and compliance standards.

Stablecoin Infrastructure Becomes Strategic Priority

The launch follows several recent steps by Visa to deepen its role in the stablecoin ecosystem, including advisory services for banks exploring issuance, custody, and onchain payments. Visa is also participating in the testing of next-generation blockchain settlement layers and plans to support validator operations once production networks go live.

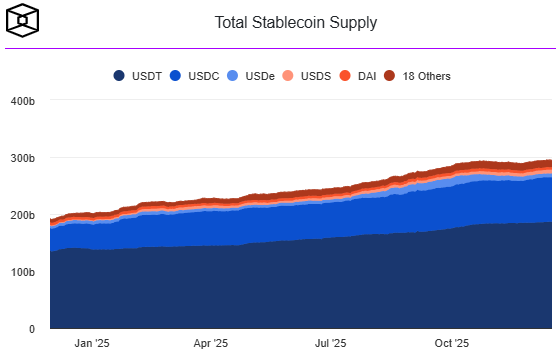

The rollout comes as the U.S. regulatory environment becomes more supportive following the introduction of a federal stablecoin framework. The stablecoin market, currently valued near $300 billion, is projected to grow significantly in the coming years. Visa’s decision to leverage Solana-native USDC reflects rising confidence in scalable public blockchains for institutional-grade payments and capital markets activity.

This development positions stablecoins as a core component of modern payment rails, bridging traditional finance and onchain settlement.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.