VistaShares has launched a new actively managed exchange-traded fund designed to blend government bonds with Bitcoin-linked income strategies. The fund, trading on the New York Stock Exchange under the ticker BTYB, allocates the majority of its portfolio to US Treasury securities while using options to gain indirect exposure to Bitcoin price movements.

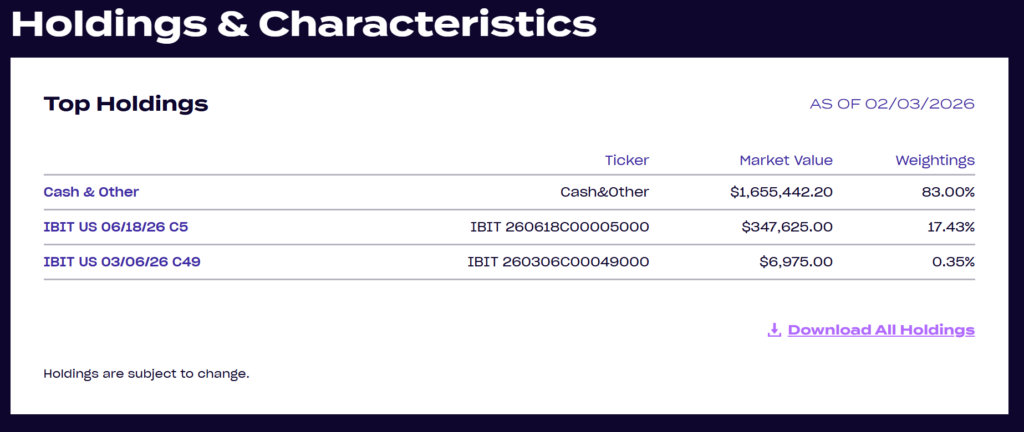

According to details released with the launch, approximately 80% of the fund’s assets are invested in US Treasurys and related instruments. The remaining 20% is tied to Bitcoin through a synthetic covered call strategy, which relies on derivatives rather than direct cryptocurrency holdings.

How the Options-Based Bitcoin Strategy Works

BTYB’s Bitcoin-linked exposure is created using call options connected to a spot Bitcoin trust. By selling call options against this synthetic exposure, the fund seeks to generate regular income from options premiums. This structure allows the ETF to offer Bitcoin-related returns without holding Bitcoin directly.

The tradeoff is that the fund does not track spot Bitcoin prices and caps potential upside in exchange for income generation. VistaShares said the ETF is designed to deliver weekly distributions and targets a yield roughly double that of a five-year US Treasury, though payouts are not guaranteed and may fluctuate based on market conditions.

Broader Shift in Crypto ETF Design

The launch reflects a broader trend among ETF issuers toward combining digital asset exposure with traditional financial instruments. As interest grows beyond single-asset crypto products, fund managers are increasingly using options and diversified structures to appeal to income-focused and risk-conscious investors.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.