Bitcoin and Ethereum Weekly Price Performance

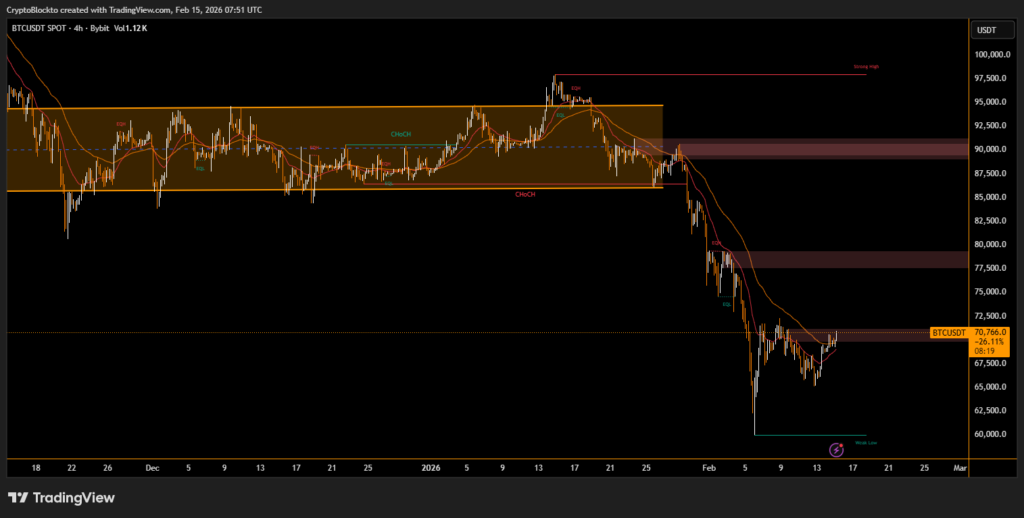

Over the week ending , the crypto market remained under pressure as risk sentiment dominated trading activity. Bitcoin started the week near $70,000, retreated sharply to lows around $65,000 mid-week, then found some footing around the $68,000–$69,000 range by Sunday. Analysts noted that Bitcoin repeatedly tested critical technical levels, including the 200-week EMA near $68,300, underscoring the cautious market structure.

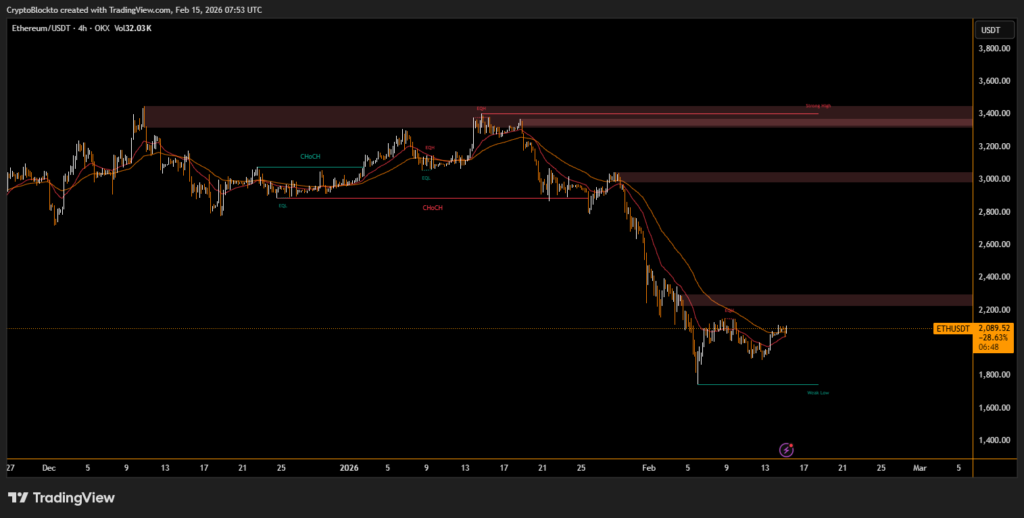

Ethereum exhibited similar volatility, slipping under $1,900 before recovering toward $2,050–$2,080 by the week’s end. Both leading digital assets reflected broader macro pressures and institutional repositioning.

BTC and ETH ETF Flows Highlight Institutional Shifts

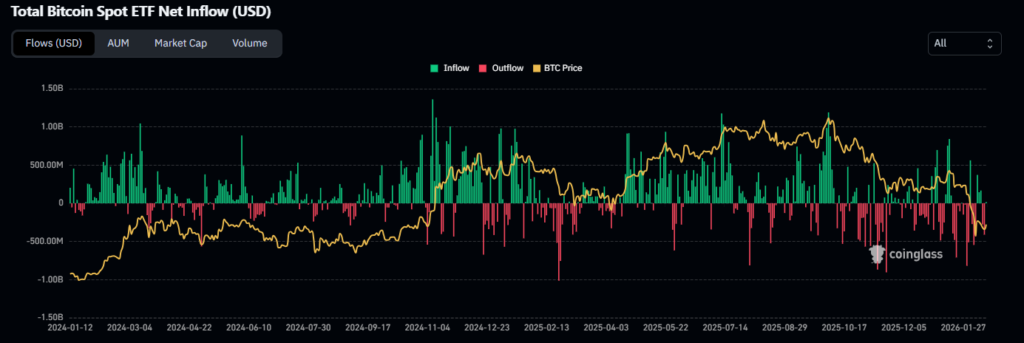

Institutional flows played a defining role this week. U.S. spot Bitcoin ETFs experienced significant net outflows of roughly $360–$375 million over the period ending Feb 13, driven by heavy redemptions mid-week, particularly on February 12.

Ethereum ETF products also saw net outflows of about $161 million for the same period despite a late-week rebound. On Feb 13, minor positive flows returned for both BTC and ETH ETFs, but weekly data remained negative, signaling continued institutional caution and repositioning in the wake of price weakness.

Altcoins and Market Breadth

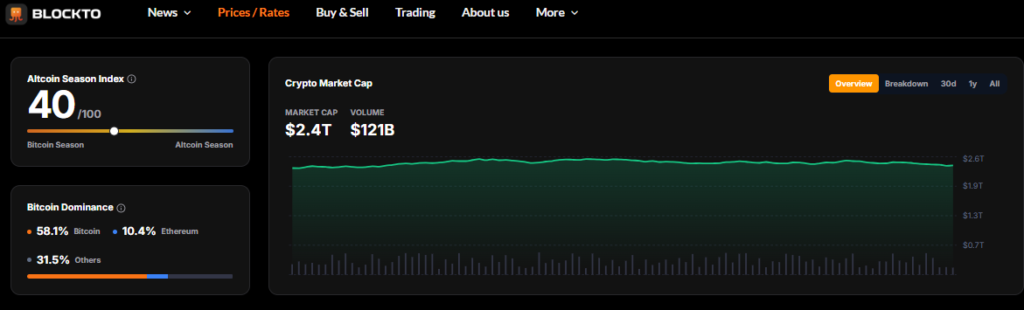

In the wider altcoin landscape, several projects saw divergent performance. Some tokens recorded notable weekly gains, while broader market capitalization contracted amid risk-off trade. Total crypto market value settled near $2.35 trillion, with sentiment indicators remaining subdued throughout the week.

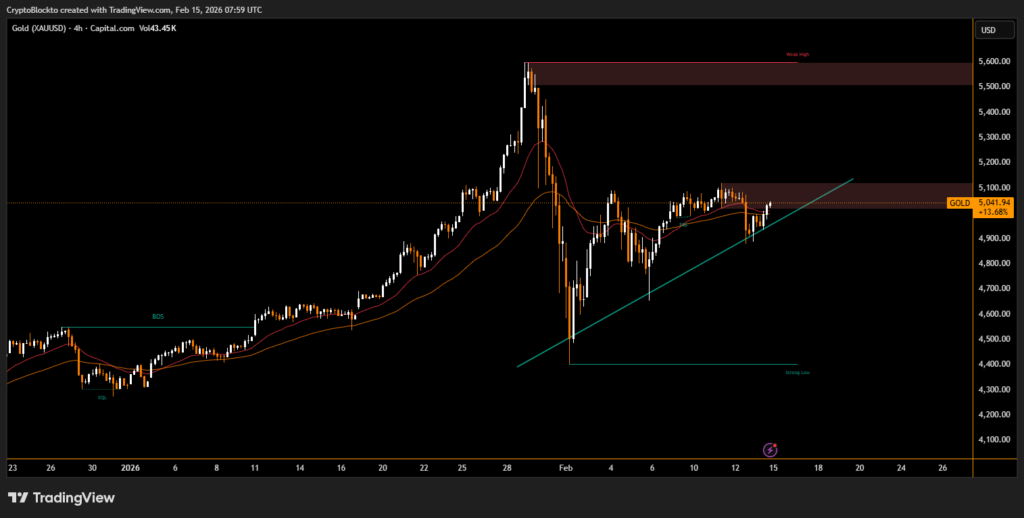

Gold’s Resilience in a Risk-Off Environment

Traditional safe-haven assets gained traction amid equity and crypto volatility. Gold continued its strong performance, sustaining levels above $5,000 an ounce, driven by safe-haven demand and macro uncertainty. This contrasted sharply with digital risk assets and underlined capital flows into traditional hedges.

The week was dominated by institutional outflows, risk-off pricing in major cryptocurrencies and continued divergence between digital assets and traditional safe havens like gold and silver. Short-term volatility and macro pressures persisted, even as technical support levels provided intermittent stability. Overall, the week reinforced that institutional sentiment and macro dynamics remain central drivers of crypto price action.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.