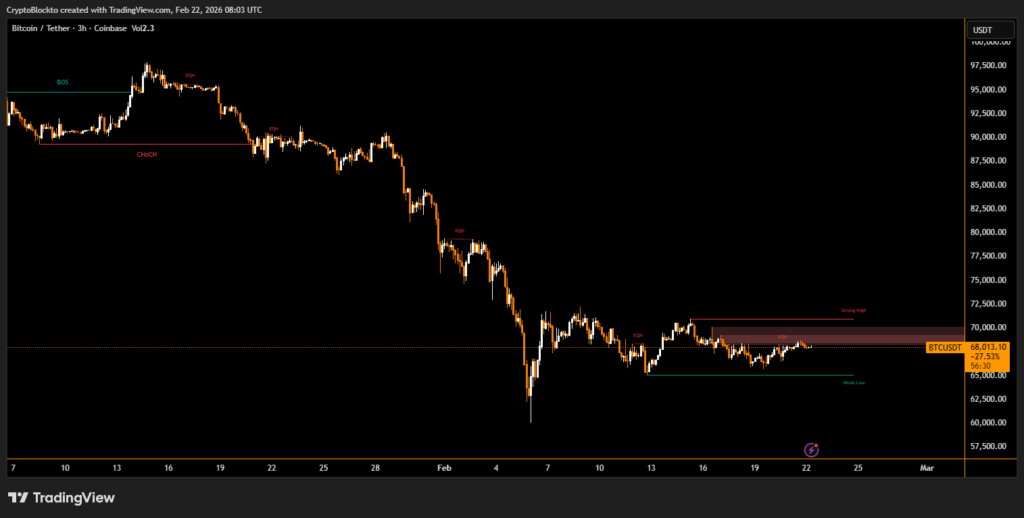

Bitcoin remained under significant selling pressure as prices oscillated in a narrow range. BTC was trading near $68k by Feb 21 after dipping below this level earlier in the week, with daily highs and lows reflecting volatile sentiment. Historical price data shows Bitcoin opened around $68,814 on Feb 15 and was roughly $68,011 on Feb 21.

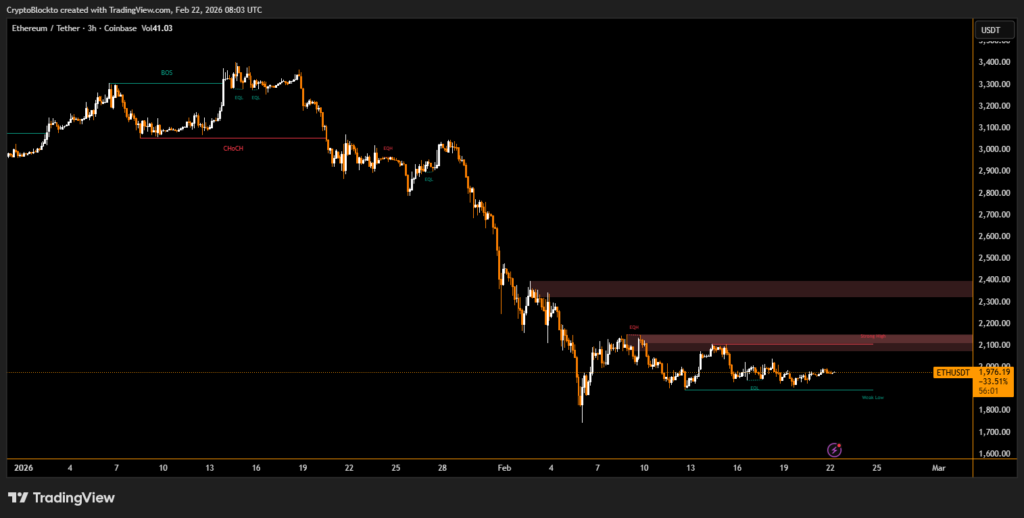

Ethereum while also subdued, held near $2,050, mirroring Bitcoin’s trend without a strong breakout. XRP tracked around $1.40–$1.50 during the same period, showing modest stabilization after earlier rebounds from lower February lows.

Market dynamics were marked by macro factors and risk aversion, constraining major crypto gains and reinforcing a cautious trading environment.

ETF Flows and Institutional Positioning

Institutional capital flows during the week continued to show net outflows from Bitcoin and Ethereum spot ETFs. Data for the week ending indicates Bitcoin spot ETFs recorded roughly $359.9 million, while Ethereum ETFs saw about $161.1 million in outflows. In contrast, SOL and XRP ETF products showed small net inflows, suggesting selective rotation toward a subset of altcoin linked products.

These ETF trends illustrate shifting investor preferences, with BTC and ETH seeing pullbacks in institutional demand, while SOL and XRP ETFs attracted modest interest.

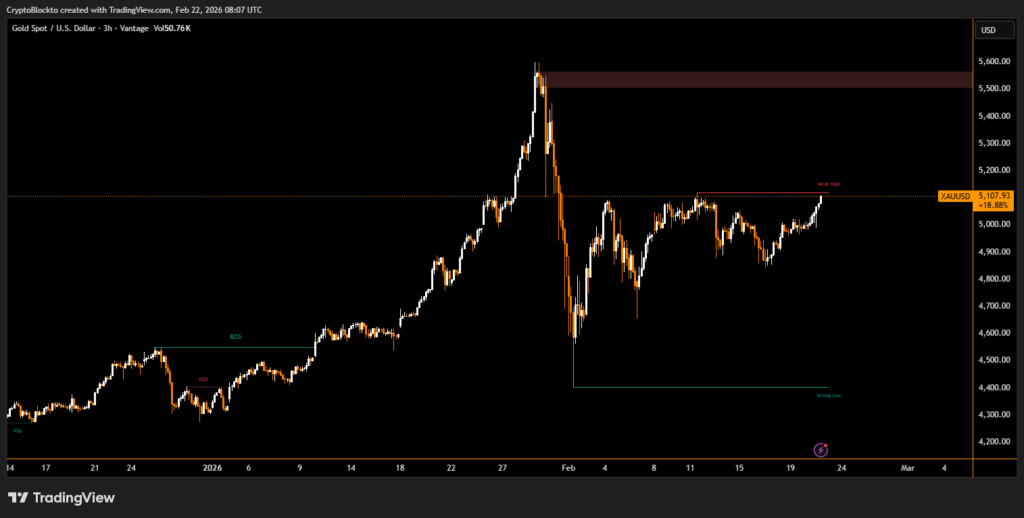

Gold Market and Safe Haven Flows

Gold prices also featured prominently in this period. Gold hovered around $5,000 per ounce, reflecting persistent safe haven demand amid macro uncertainties.

The sustained gold price around multi-thousand-dollar levels indicates continued capital flows into traditional safe assets as crypto risk assets faced downward pressure.

Bitcoin Outlook and Market Sentiment

Bitcoin has closed positive in 50% of the past 24 months, prompting economist Timothy Peterson to project an 88% chance of higher prices by December. Despite trading 25% below its yearly open, strong November seasonality and extreme fear sentiment suggest potential upside amid divided analyst expectations.

Overall, this week highlighted continued volatility in crypto valuations, rotation in institutional flows, and strong safe-haven interest in gold as global uncertainties persist.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.