The final week of December 2025 closed with a stark divergence between traditional safe-haven assets and major cryptocurrencies reflecting shifting investor sentiment in global financial markets. While precious metals surged to historic highs, digital assets such as Bitcoin and Ethereum traded within tight ranges under significant resistance.

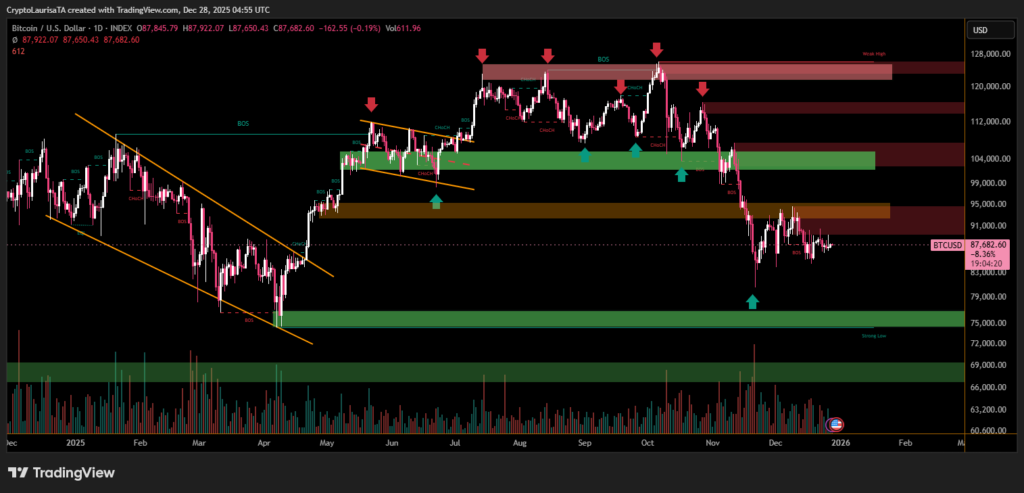

Bitcoin Holds Under Pressure as Rally Falters

Bitcoin’s price action through the week was marked by range-bound consolidation and resistance near key levels. By Dec 26, BTC was trading above the $88,000 mark, but could not decisively break higher, staying under pressure amid low holiday liquidity and resistance near $89,000–$90,000.

Bitcoin’s price dipping modestly on the day, reflecting a 7-day return that hovered slightly negative amid subdued volume and year-end rotation out of crypto.

This pattern reinforces recent trends in which Bitcoin lags behind alternative asset rallies and highlights the ongoing struggle to reclaim breakout momentum above $90K.

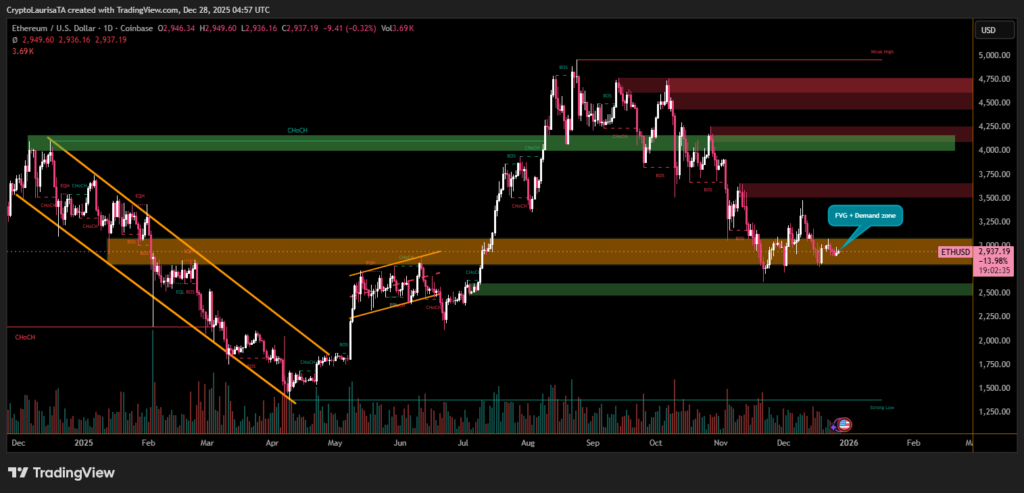

Ethereum Steady, Low Volatility but Holding Ground

ETH held around the $2,900–$3,000 range, showing modest strength relative to BTC and supporting broader network stability indicators. While gains were limited by thin holiday trading, Ethereum’s position near key psychological levels suggests investors are maintaining exposure despite lackluster short-term gains.

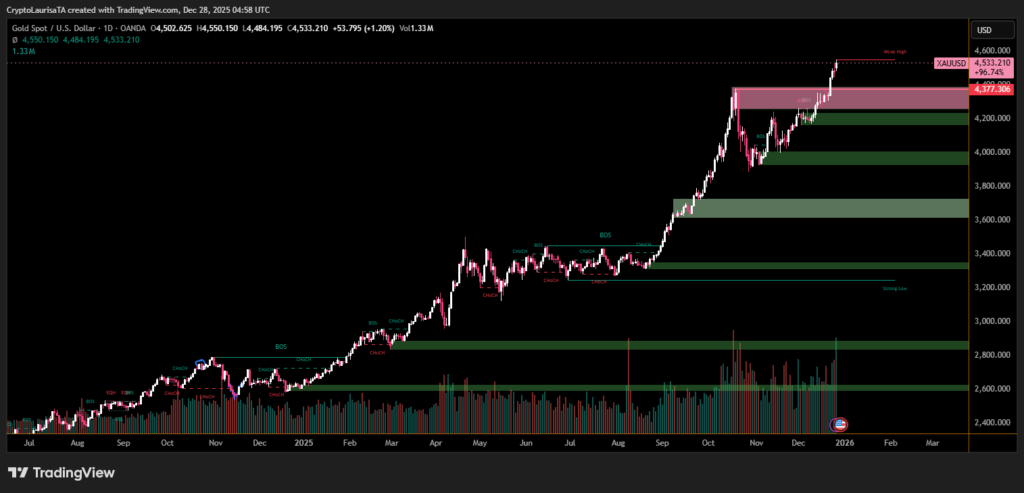

Gold and Silver Rally to New Highs

In contrast to crypto’s muted performance, precious metals dominated financial headlines. gold and silver reached record levels, driven by strong safe-haven demand, expectations of lower interest rates, and industrial demand pressures.

Gold traded above $4,550 per ounce, while silver surged past $75 per ounce, marking a historic high and a standout performance among commodities.

This rally not only underscores macroeconomic hedging behavior but also highlights a rotation of capital toward traditional stores of value, even as monetary policy expectations evolve.

- Bitcoin remained range-bound below $90K, reflecting resistance and low volume.

- Ethereum showed relative stability but lacked strong breakout signals.

- Gold and silver dominated as key safe-haven assets, achieving historic price levels.

The contrast between crypto consolidation and metals momentum encapsulates the current market narrative: investors are cautious on digital assets while favoring tangible stores of value into year-end and possible policy shifts in 2026.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.