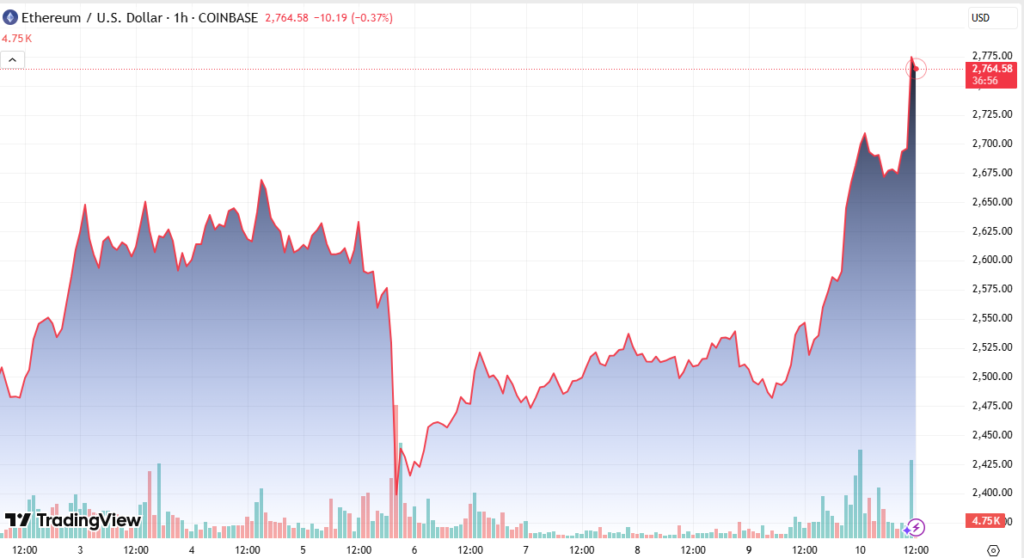

Ethereum (ETH) recorded a sharp 7% surge on June 10, trading above $2,680 and pushing the market higher with strong investor momentum. The rally is backed by a combination of institutional inflows, rising futures open interest, and bullish technical patterns.

Strong Demand Reflects in Volume and Price

As of June 10, Ethereum was trading at $2,679, marking a 7% gain in 24 hours. More significantly, daily trading volume jumped 114% to $26.5 billion, highlighting growing demand-side pressure.

This volume surge reflects increasing trader confidence and short-term price momentum.

Consistent Ethereum ETF Inflows

One of the primary drivers is the seventh consecutive week of inflows into Ethereum-based investment products. The past week alone saw $295.4 million in net inflows, bringing the seven-week total to $1.5 billion.

This marks the strongest inflow streak since the U.S. election in November 2024, signaling a clear shift in institutional sentiment toward Ethereum. Analysts suggest that the narrative is expanding from Bitcoin as “digital gold” to Ethereum as the infrastructure for tokenized real-world assets.

Record Open Interest and Positive Funding Rates

Another bullish catalyst is the record-high open interest (OI) in Ether futures. On June 10, aggregate OI rose 12.7% to $39.22 billion, according to market data. Over 51% of this open interest is held by major crypto exchanges like Binance, Bybit, and Bitget, while the Chicago Mercantile Exchange (CME) controls 7.4%, confirming rising institutional engagement.

Positive funding rates in ETH perpetual futures markets also support the uptrend. The rate increased to 0.0070% from 0.0026% in just two days — a clear signal that long positions are gaining strength over shorts.

Bullish Chart Pattern Targets $4,100

Technically, Ether is breaking out of a cup-and-handle pattern, a bullish structure that historically leads to significant price increases. The breakout suggests a potential price target near $4,100 if momentum sustains and macro conditions remain favorable.

Conclusion

Ethereum’s rally is not a random spike but a reflection of growing institutional confidence, technical strength, and bullish market structure. As Ethereum ETFs continue to attract capital and derivative markets show support, the path to higher prices seems increasingly probable.