Ethereum (ETH) experienced a relatively stable trading session over the past 24 hours, with price fluctuations reflecting a broader consolidation across the crypto market. After briefly touching an intraday high of $2,976, the price faced mild selling pressure and is currently trading near $2,957, representing a 0.5% decline from its previous day’s close.

Ethereum Trading Range and Market Statistics

During this period, Ethereum traded within a narrow band between $2,908 and $2,976, suggesting reduced volatility after recent upward momentum. This range highlights a short-term equilibrium between buyers and sellers as market participants await a new catalyst.

Ethereum’s market capitalization stands at approximately $355 billion, securing its position as the second-largest cryptocurrency by total market value. The 24-hour trading volume is estimated at over $11.2 billion, indicating continued interest among institutional and retail traders alike.

Technical Overview: Support and Resistance Levels

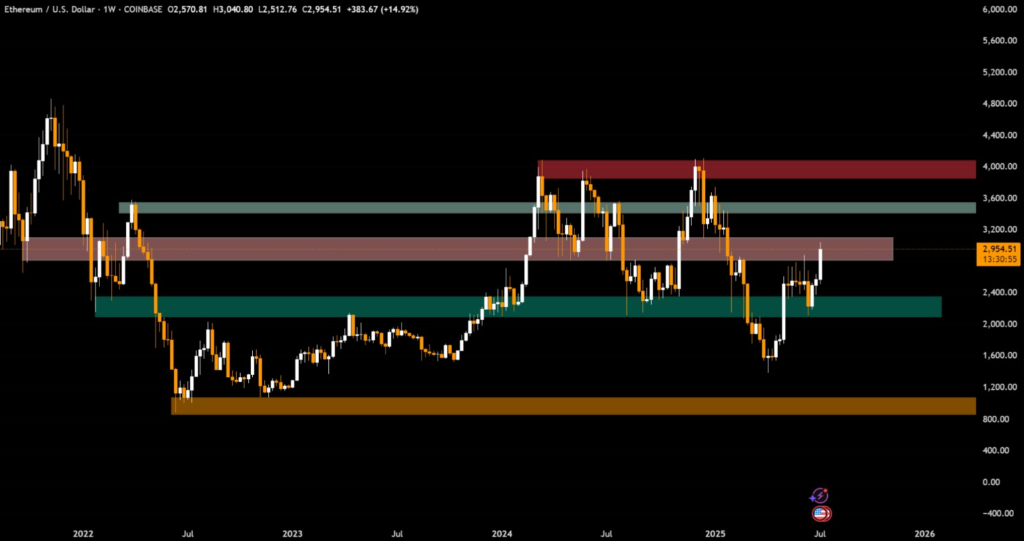

On the technical front, Ethereum is currently holding above the key support level of $2,900. A sustained move below this threshold could open the door to further downside, potentially targeting the $2,850 region.

Meanwhile, resistance remains strong near the $3,000 psychological barrier, a level Ethereum has attempted to break multiple times in recent weeks. A daily close above $3,000 could trigger bullish momentum, with the next upside target around $3,120 based on recent swing highs.

Weekly Performance and Investor Sentiment

Over the past week, Ethereum has posted a modest gain of approximately 3.2%, reflecting cautious optimism among investors. This mild uptick comes amid steady development in Ethereum’s ecosystem and increasing engagement in staking and layer-2 scaling solutions.

Despite today’s slight pullback, market sentiment remains largely neutral to bullish, driven by broader macro stability and anticipated developments in decentralized finance and Ethereum-based applications.

Consolidation Ahead of Breakout?

While Ethereum has not shown sharp movement in the last 24 hours, the current price consolidation may be a sign of accumulation. If support at $2,900 holds firm and volume increases, a breakout toward $3,000 and above remains a realistic near-term scenario.

Traders are advised to monitor volume trends, RSI levels, and Ethereum’s behavior near resistance zones for clearer direction in the coming days.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.