Solana (SOL) is trading higher today, climbing 9.5% in 24 hours to reach $157, driven by ETF optimism, rising institutional interest, and a bullish chart setup. With trading volume surging over 100% to $4.5 billion, momentum is clearly on the bulls’ side.

1. Solana ETF Approval Odds Spike to 91%

The main catalyst for today’s rally is growing speculation around a spot Solana ETF approval in the United States.

Polymarket shows a 91% chance of ETF approval, up from 77.5% less than 10 days ago.

Multiple firms — including VanEck, Grayscale, 21Shares, Bitwise, Franklin, and Canary Capital — have filed S-1 forms with the U.S. SEC, while Invesco and Galaxy Digital aim to launch a Solana ETF Trust in Delaware.

ETF approval could unlock billions in institutional capital, driving further demand for SOL.

2. SOL Futures Market Signals Institutional Demand

SOL’s rally is further supported by high activity in the derivatives market.

- Futures open interest hit 45.87 million SOL on June 12 — the highest in over two years.

- It now stands at 43.86 million SOL, or $6.86 billion, ranking third in the crypto market.

Open interest surged 22% in 30 days, signaling strong leveraged bets on SOL upside.

On platforms like Binance, the long/short ratio is skewed bullish, reinforcing market confidence.

3. Bull Flag Pattern Points to $315 Target

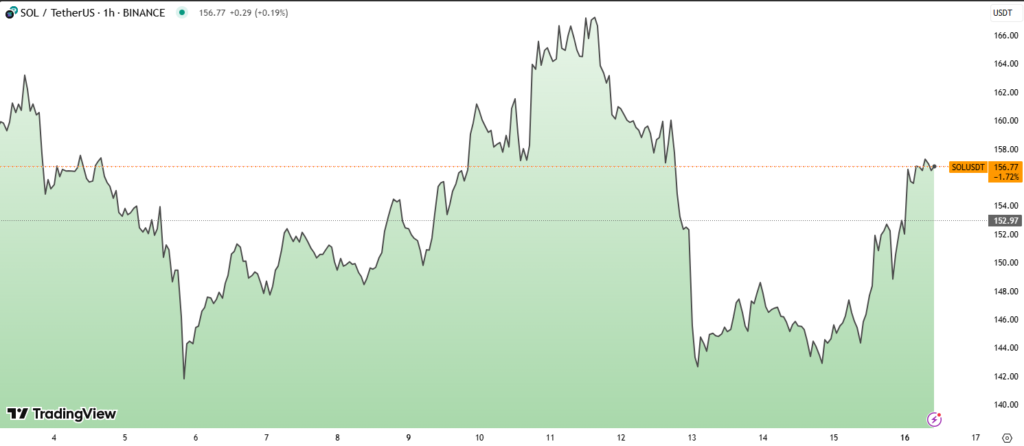

Technically, SOL is forming a bull flag — a bullish continuation pattern following a sharp uptrend.

If confirmed, the pattern projects a potential breakout target of $315, doubling today’s price.

Key resistance lies at the 50-day SMA near $161. A break above this could confirm the pattern and spark another leg higher.

Conclusion: Momentum Builds for Solana’s Breakout

Solana’s price surge is backed by ETF optimism, strong derivatives demand, and a bullish technical setup. If these factors continue aligning, SOL may be poised to retest previous highs — or even reach $300+ levels in the coming months.

Solana’s current rally is not just speculative — it’s being driven by real market interest and institutional traction.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.