XRP Price Surges 8% Amid Whale Buying and Bullish Market Structure

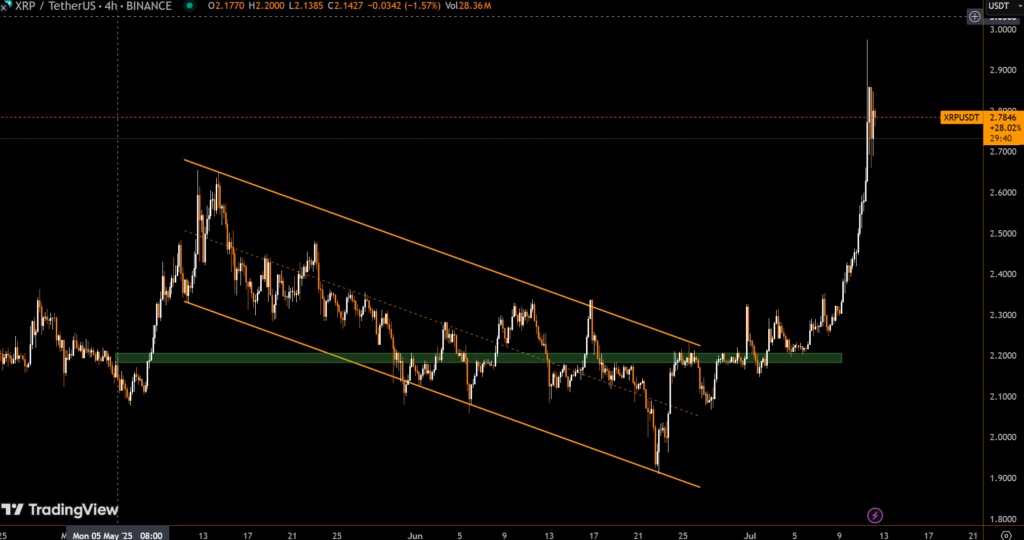

XRP, the native token of the Ripple network, has seen a sharp price rally over the past 24 hours, jumping from $2.58 to a peak of $2.96 before settling near the $2.78–$2.80 range. This 8% gain has reignited investor interest, with analysts and traders now watching the key $2.90 to $3.40 resistance zone for a potential breakout.

Whale Positions and Leverage Spark Momentum

On-chain and derivatives data indicate a significant whale-driven move. A single $14 million leveraged long position was opened on Hyperliquid, a popular crypto derivatives platform, at a price of $2.30. This kind of aggressive positioning suggests high conviction among institutional or high-net-worth investors.

The position coincides with XRP breaking out of an ascending triangle pattern, a bullish technical formation known for preceding sharp upward movements. Volume surged past 375 million tokens between 13:00 and 15:00 UTC on July 11, reinforcing the strength behind the move.

Technical Picture: Breakout to $3.40 on the Table?

XRP has shown resilience above the $2.70–$2.75 support zone, with buyers stepping in on every dip. The intraday volatility of 14%, combined with a trading range of $0.35, illustrates increasing investor interest and market activity.

Analysts are now watching the $2.90 to $3.40 band as the next key resistance. A confirmed breakout with high volume through this zone could pave the way toward $3.40, and potentially higher levels in the coming weeks.

Institutional Adoption and RLUSD Fuel Long-Term Confidence

Beyond technicals, fundamental developments continue to support XRP’s case. Ripple’s expanding ecosystem — particularly the RLUSD stablecoin initiative and cross-border payment integrations — is drawing increasing institutional attention. These moves are boosting long-term confidence in XRP as a utility-focused asset.

What to Watch Next

- Support: $2.70 remains the short-term anchor.

- Resistance: Watch the $2.90 level — a breakout above this could be the next leg up.

- Volume Confirmation: A move with over 200 million tokens traded through $2.90 would be a strong bullish signal.

- Risk Zone: Failure to hold above $2.70 could lead to a pullback toward $2.58.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.