Onchain analyst Willy Woo has warned that growing concerns around quantum computing are beginning to challenge Bitcoin’s long-standing valuation premium over gold.

Woo argued that markets may be factoring in the possibility of a future “Q-Day” — the point at which quantum computers become powerful enough to break current public-key cryptography. Such a breakthrough could potentially expose older Bitcoin addresses whose public keys are already visible onchain.

Estimates suggest roughly 4 million BTC — often considered “lost” coins — sit in addresses that could be vulnerable in a quantum attack scenario. If quantum machines were capable of deriving private keys from exposed public keys, these coins could theoretically re-enter circulation, reshaping Bitcoin’s scarcity narrative.

Governance Debate: Freeze or Protect?

Woo estimates there is only a 25% probability that the Bitcoin network would agree to freeze vulnerable coins through a hard fork. Such a move would likely spark intense governance debates over immutability, fungibility and property rights — foundational principles of the network.

Some developers argue that Bitcoin has time to migrate gradually toward quantum-resistant cryptography without resorting to emergency measures. Others note that even if vulnerable coins became accessible, they may not immediately flood the market.

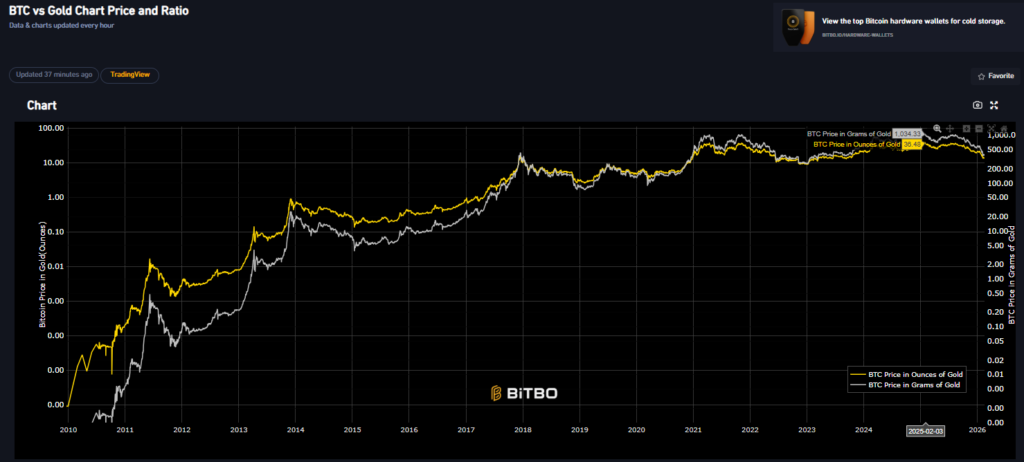

Still, with Bitcoin trading well below its all-time high, quantum risk is increasingly being viewed as a long-term structural consideration for institutional investors comparing Bitcoin with gold.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.