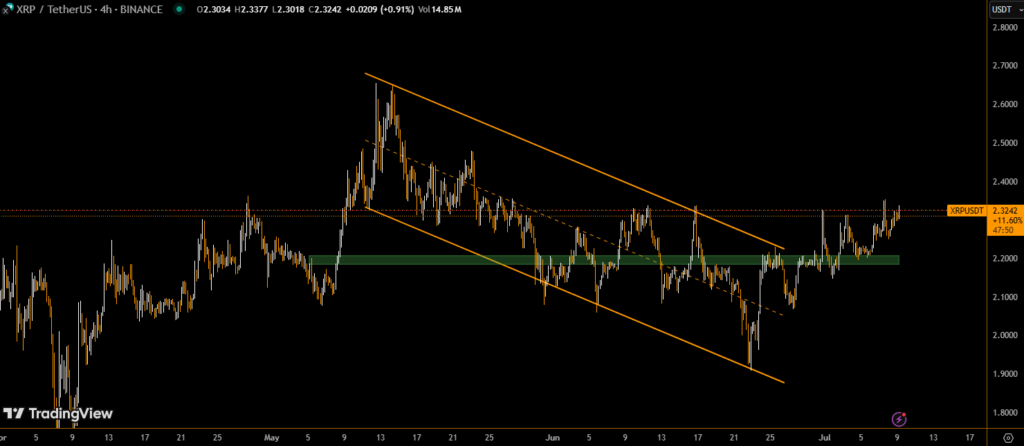

XRP is showing renewed bullish strength after breaking above the $2.28 resistance level, a move largely driven by Ripple’s ongoing push to secure a U.S. national banking charter. With volume backing the breakout and structural support zones holding firm, market watchers are now eyeing the $2.38 level as the next critical threshold.

Ripple’s Bank Charter Application: A Regulatory Turning Point

Ripple’s recent filing for a national trust bank license with the Office of the Comptroller of the Currency (OCC) is being viewed as a watershed moment. This application signals the company’s intent to embed itself deeper into the regulated financial ecosystem—making XRP one of the few major altcoins positioned for institutional adoption under legal clarity.

This development has strengthened investor confidence and contributed to XRP’s latest breakout, especially as institutional traders continue to rotate toward compliant, utility-driven assets.

Price Action and Volume Surge Confirm Breakout

Between July 6 at 03:00 and July 7 at 02:00 UTC, XRP advanced 2.36%, climbing from $2.21 to $2.26. The price then surged past the $2.28 mark on strong buying momentum, printing an intraday high of $2.29.

A sharp volume spike — over 67 million XRP traded during the 10:00 hour — confirmed the breakout above $2.28 and marked a shift in short-term market structure.

By the session’s final hour, XRP climbed again from $2.26 to $2.27, supported by smaller volume surges around 01:30 and 02:01 UTC, indicating ongoing bullish momentum into the next trading session.

Key Technical Levels to Watch

- Support: $2.24–$2.25 has been successfully defended by buyers and is now a strong support zone.

- Resistance: The $2.28–$2.29 area is acting as immediate resistance. A confirmed flip of this level would open the path to $2.38, followed by $2.60 and $3.40 as potential extension targets.

- Volume Validation: Breakout points at 08:00, 10:00, and 13:00 UTC all occurred on elevated volume, lending weight to the upward move.

Why XRP Remains Structurally Bullish

With its ongoing legal clarity in the U.S., XRP continues to be a rare case among large-cap tokens. Its strong fundamentals — including Ripple’s real-world payment network, regulatory advancements, and institutional alignment — provide a compelling backdrop for long-term accumulation.

A successful close above $2.28 with consistent volume would solidify bullish sentiment and may initiate a broader rally toward multi-year highs.

However, if $2.25 fails to hold, the next demand zone lies between $2.21–$2.22, which previously served as a springboard for the recent uptrend.

Momentum Builds on Both Technical and Fundamental Fronts

With Ripple’s banking charter application acting as a bullish catalyst and technical confirmation through volume and price, XRP finds itself at a pivotal moment. Traders are closely watching price action above $2.28, as this zone may determine whether the token targets $2.38 and beyond in the near term.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.