InterestExchange reserves decline as accumulation trend strengthens amid market recovery

XRP Price Analysis: Bulls Regain Momentum After Sharp Selloff

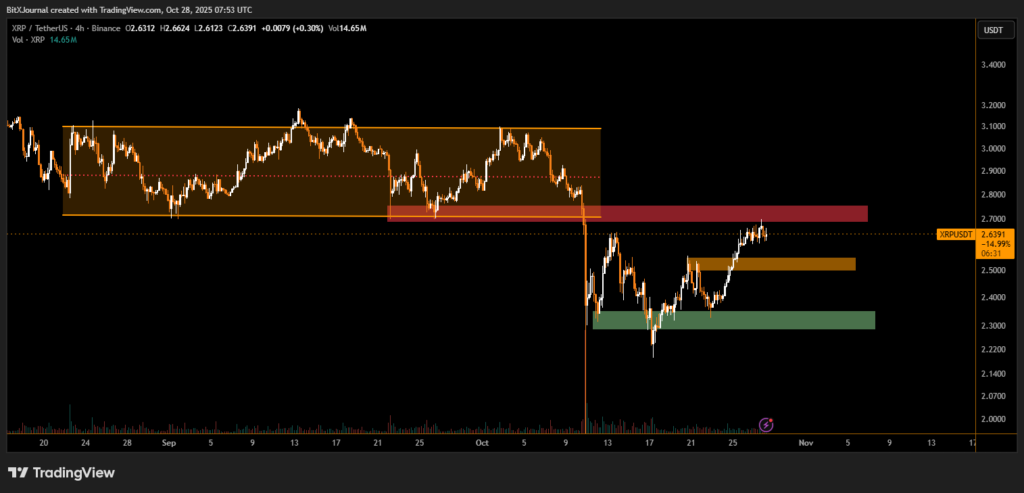

XRP has edged higher to $2.63, recovering strongly after last week’s steep decline, as trading volume surged across major exchanges. The 4-hour chart shows that XRP is rebounding from a key demand zone near $2.35–$2.40, while facing resistance around $2.70–$2.75, a region where sellers previously dominated.

Onchain analytics reveal a 3.36% drop in exchange reserves since early October, indicating that investors are moving tokens off exchanges — a historically bullish signal often associated with accumulation phases. The shift suggests that long-term holders may be positioning for a continuation of the uptrend if broader market sentiment remains supportive.

Technical Structure Points to a Gradual Recovery

Chart data highlights that XRP recently broke out of a short-term descending pattern, forming higher lows and consolidating near a critical resistance block. The red zone between $2.70 and $2.80 remains the immediate barrier, while the green support zone around $2.35 underpins the ongoing recovery.

BitXJournal market strategist commented, “The compression seen below $2.70 suggests a buildup in buying pressure. If volume continues rising, XRP could attempt a clean breakout toward the $2.90–$3.00 zone.”

Another analyst added, “The drop in exchange reserves signals reduced selling liquidity, which is typically a precursor to upward momentum in spot markets.”

Traders are monitoring whether XRP can close above $2.75 on strong volume — a move that could confirm a bullish continuation pattern. Failure to do so may lead to a retest of the mid-$2.40 support region, where new buyers have recently emerged.

Overall, XRP’s market structure is turning constructive, supported by declining exchange supply, rising volume, and higher lows on the chart. If accumulation continues, technical analysts suggest that the asset could soon target the $3 psychological resistance, potentially marking a shift back into a medium-term bullish cycle.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.