Spot ETF Inflows Signal Ongoing Institutional Accumulation Despite Price Weakness

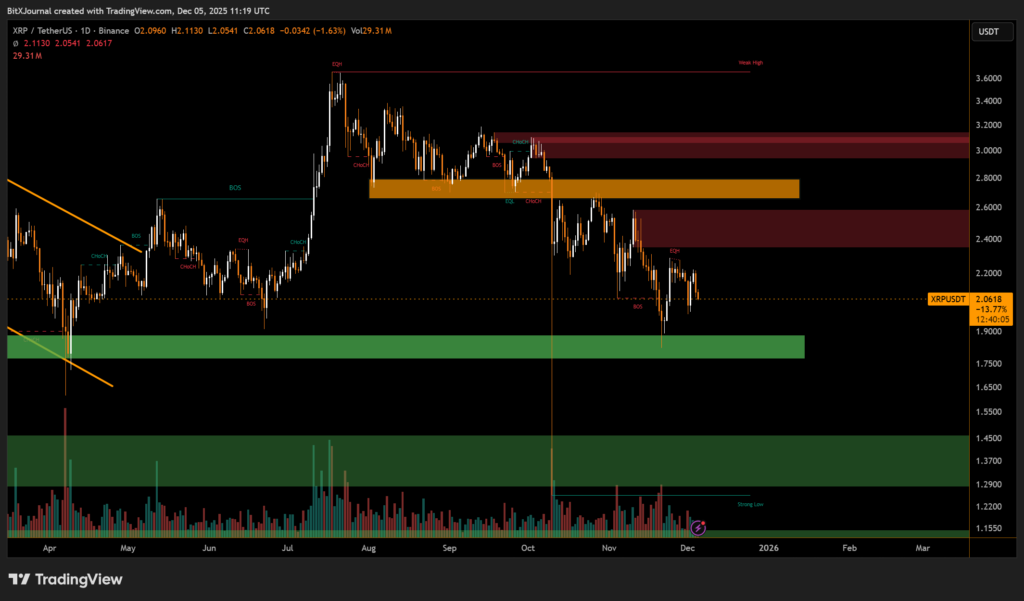

XRP’s price action has turned cautious as the market approaches a critical support area, with traders closely monitoring whether the asset will revisit the $2.05 level in the coming sessions. The pullback comes as broader crypto sentiment softens, driven in part by Bitcoin surrendering its latest weekly gains after a period of volatility.

Despite the near-term weakness, market data shows sustained institutional interest in the asset. Spot XRP ETFs, launched in mid-November, have already accumulated nearly $850 million in inflows, marking one of the strongest starts for any altcoin-focused exchange-traded product. This steady capital movement suggests that long-horizon investors continue adding exposure even as short-term traders reduce risk.

On the technical front, the chart indicates that XRP remains below a cluster of overhead supply zones near $2.30–$2.60, where sellers have repeatedly reacted. Price has been rejected multiple times from these levels, reinforcing the significance of the upper red resistance bands.

In the near term, maintaining structure above $2.05 is crucial, as losing this support may expose the market to a deeper decline toward the broader demand region highlighted on the chart. Analysts warn that such a retest remains possible if selling pressure persists.

Still, institutional inflow strength provides a counterbalance to bearish pressure. Underlined signals of long-term demand—such as rising ETF exposure—suggest stronger hands continue to accumulate, even as short-term volatility tests key support levels.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.