Traders eye consolidation as Ripple’s token steadies near critical support

XRP is holding firm above the $2.90 level, a key price area that has become an important line of defense for bulls. The token’s ability to maintain this level comes at a time when the market is awaiting fresh developments on potential ETF decisions, which could significantly impact sentiment across the crypto sector.

Technical outlook shows support resilience

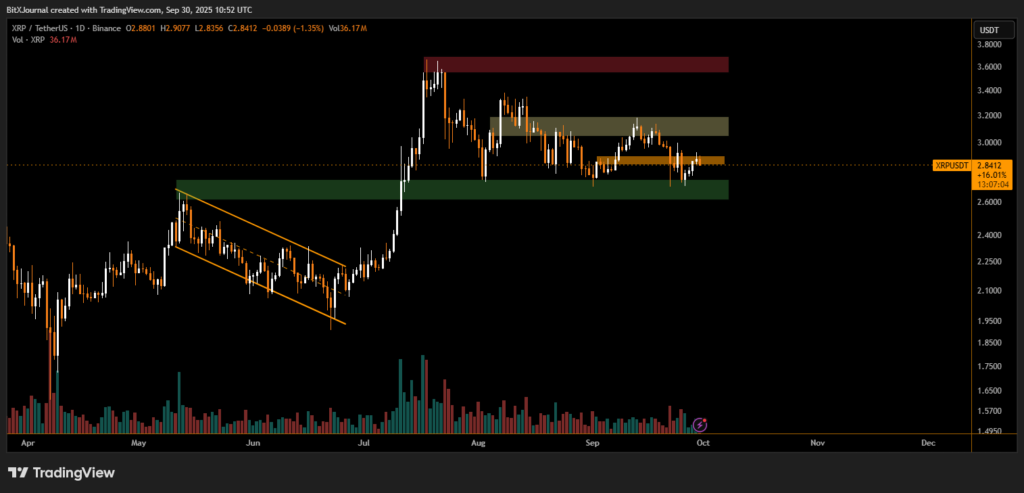

The daily chart highlights how XRP recently tested the $2.80–$2.90 demand zone (green band), managing to stay above it despite broader market fluctuations. This zone has previously acted as a pivot for both rallies and pullbacks, underlining its importance in the current structure.

“The $2.90 support is crucial for XRP’s short-term stability. A sustained close below it could expose the token to deeper pullbacks toward $2.60, while holding this level may set up another push higher,” According to BITX analysts.

Above current prices, XRP faces immediate resistance near $3.20 (gray zone), followed by a major barrier at $3.70–$3.80 (red supply area). These levels have repeatedly capped bullish attempts over recent months, making them the key breakout points for traders to watch.

Beyond technicals, the looming ETF rulings are a source of anticipation. Analysts argue that favorable outcomes could inject renewed momentum into altcoins like XRP. “Institutional-friendly approvals could boost liquidity and drive larger capital inflows into established assets,” BITX market strategist explained.

For now, XRP remains range-bound between the $2.90 support and $3.20 resistance. Consolidation in this zone reflects uncertainty, but also stability, as traders weigh macro catalysts alongside technical structures.

XRP’s defense of the $2.90 level provides a constructive signal for bulls ahead of critical ETF-related decisions. A breakout above $3.20 could open the path toward a retest of $3.70–$3.80, but a loss of momentum at current levels risks pulling the token back into lower consolidation ranges.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.