Failure to hold above $2.12 signals weakening momentum amid visible distribution zones

XRP attempted to extend its recent rebound after briefly pushing past the $2.12 resistance level, but the move quickly lost strength. The token reached as high as $2.17 before sellers regained control, signaling that bullish momentum remains fragile despite broader market stability.

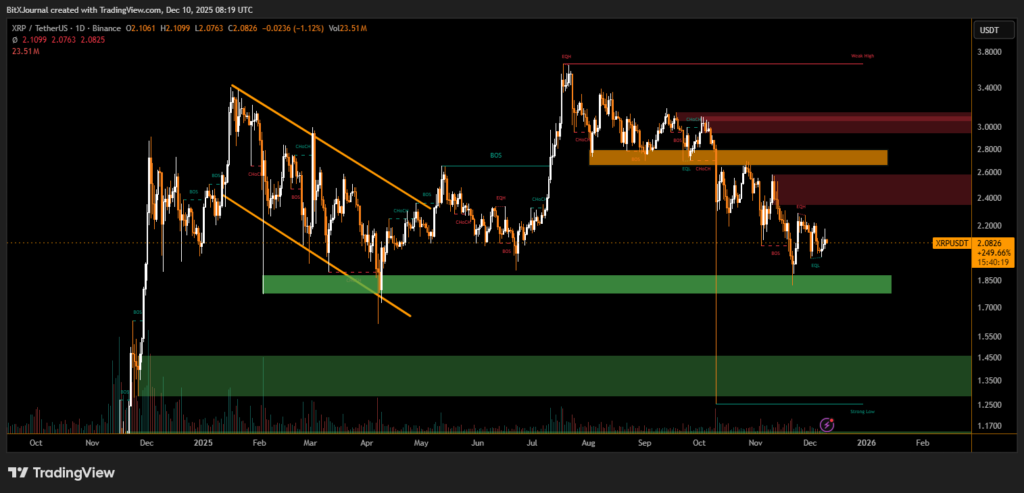

The market indicates that XRP continues to trade below a series of major supply zones, particularly between the mid-$2.40 and $3.10 ranges, where multiple bearish order blocks formed earlier in the cycle. These levels represent historically heavy distribution points where large holders previously exited positions, reinforcing strong resistance for any upside continuation.

XRP’s failure to sustain above $2.12 coincides with repeated rejections across these upper bands. The presence of equal highs and multiple break-of-structure signals further highlights how the market is struggling to establish a clean bullish continuation pattern.

At the same time, price recently rebounded from a broad demand zone near the $1.85 area. While this level still provides meaningful support, the lack of follow-through buying above $2.12 raises concern that the bounce may be losing momentum.

Sell Pressure or Consolidation?

The swift rejection from $2.17 suggests that large holders may be unwinding positions rather than accumulating, creating overhead supply that caps upside attempts. For bullish confirmation, XRP would need sustained closes above the $2.12–$2.20 region accompanied by expanding volume. Without this, the current structure leans toward continued sideways movement or a potential retest of lower demand levels.

For now, the price action reflects a cautious environment in which short-term rallies face immediate supply, limiting XRP’s ability to reclaim a clear upward trend.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.