XRP Extends Decline Toward Key Support After Repeated Breaks of Structure

XRP is trading near a crucial higher-timeframe demand zone after a persistent series of lower highs and structural breaks that have weakened bullish momentum over recent weeks. The latest rejection from mid-range supply has pushed the asset toward levels that previously triggered aggressive accumulation. The market now watches whether buyers can defend this floor or if deeper downside liquidity will be targeted.

XRP Under Pressure as Structure Turns Bearish

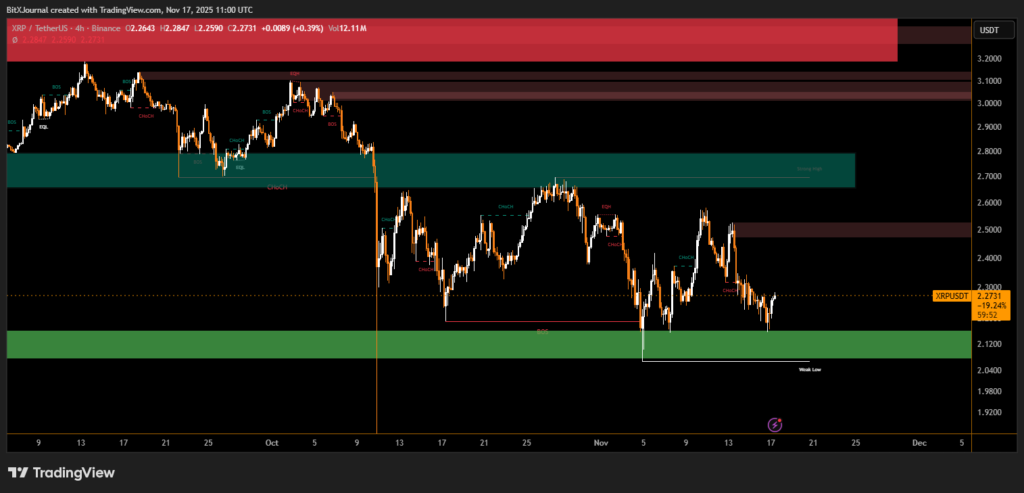

The 4-hour chart shows XRP slipping back into a wide green demand block around the $2.10–$2.18 area. This region has historically provided stability, but its repeated testing underscores fading buyer strength. A clearly marked Break of Structure (BOS) earlier in November confirmed the shift from accumulation to distribution, followed by multiple Change of Character (ChoCH) signals that reinforced the bearish trend.

BitXJournal analyst reviewing the structure noted that the market has been responding cleanly to supply levels:

“We’ve seen consistent rejections from every major inefficiency above $2.45. Until XRP can reclaim a strong high and close above key premiums, the bias remains defensive.”

BitXJournal market watcher added that the liquidity picture favors deeper moves:

“The recent sweep of the weak low suggests liquidity is being engineered for a potential continuation. If the current demand zone breaks cleanly, traders should expect a slide into untouched liquidity beneath $2.05.”

Supply Zones Cap Recovery Attempts

The chart highlights multiple unmitigated supply blocks between $2.45–$2.75 and a larger cluster above $3.00, each having triggered decisive rejections. These zones form a layered ceiling that XRP must overcome to regain bullish market structure.

Technical specialists emphasize that underlined supply regions often define the roadmap during downtrends, especially when volume thins and reactive buying slows.

XRP now sits at a structural crossroads. The $2.10–$2.18 zone remains the most important support in the short term, and a firm reaction here could open room for recovery back toward mid-range inefficiencies. However, a confirmed breakdown may expose the asset to deeper liquidity probes, forcing traders to reassess bullish expectations. With lower-timeframe structure still leaning bearish, market participants anticipate heightened volatility ahead as XRP tests this critical range.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.