The cryptocurrency XRP has gained over 3.5% in the last 24 hours, and derivatives data suggests the rally may be far from over. Options market activity and a bullish breakout in the XRP/BTC pair are building a compelling case for continued upside.

XRP $3 Options Dominate Derivatives Market

According to market data, the $3 strike call option for XRP is now the most traded, with over 2 million contracts exchanged — mostly on the buy side. This suggests that traders are positioning for a strong move above the $3 mark by July 25, the option’s expiration date.

The surge in open interest and buyer-driven volume indicates rising investor confidence in XRP’s near-term outlook.

Additionally, calls at $4.00 and $2.80 for September have gained traction, but most selling pressure appears centered at $2.80, while bullish bets target $3 and above.

XRP ETF Approval Hopes Fuel Optimism

The bullish sentiment is being reinforced by growing expectations for a spot XRP ETF in the United States. Analysts now estimate a 95% probability of approval by the U.S. Securities and Exchange Commission (SEC), according to recent updates.

A potential ETF listing would open XRP to significant institutional flows and mark a milestone in regulatory acceptance.

Adding to this, Ripple has applied for a U.S. national banking license. If approved, the firm would operate under both state and federal oversight — a move seen as strengthening its position in the regulated stablecoin and payments markets.

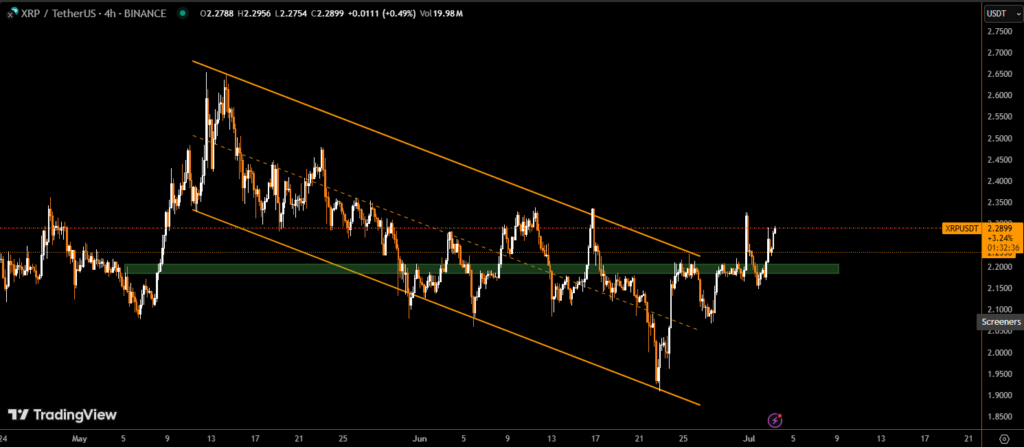

XRP/BTC Breaks Bullish Wedge Pattern

On the technical front, XRP has also made a bullish breakout against Bitcoin. The XRP/BTC pair has exited a falling wedge pattern, typically a reversal signal, suggesting the April correction has ended.

This pattern confirms renewed buying strength, even as traditional moving averages (50, 100, and 200-day SMAs) still trend lower.

Despite the SMA crossovers suggesting bearish momentum, analysts emphasize that wedge breakouts take precedence over lagging indicators like SMAs.

Conclusion: $3 XRP in Sight

With a combination of strong options activity, ETF optimism, and technical breakout patterns, XRP’s momentum appears to be building. While resistance levels remain, the data suggests that the market may be preparing for a test of the $3 threshold — and potentially higher.

If momentum holds, XRP may enter a new bullish phase heading into Q3 2025.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.