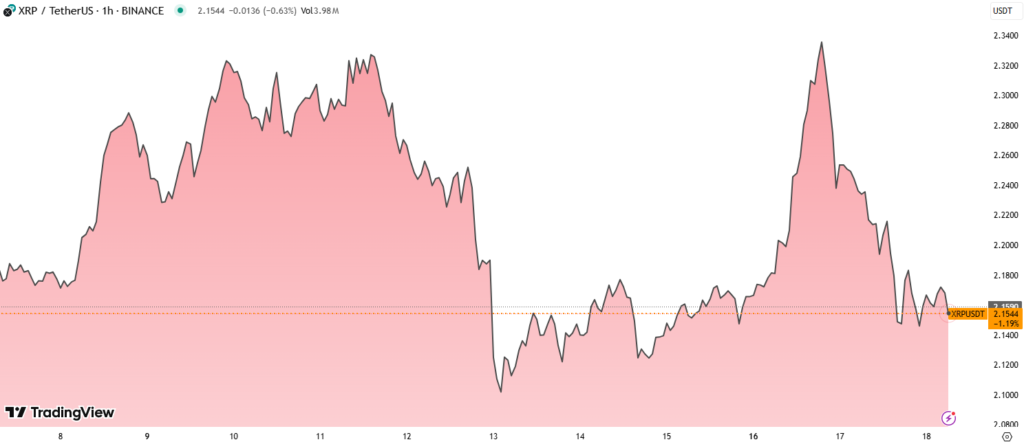

XRP faced a sharp sell-off over the last 24 hours, dropping by 4.5% as bearish sentiment intensified. The token slipped from $2.254 to $2.164, breaching key support levels and facing renewed pressure from short-term traders.

Bearish Momentum Breaks Key Support

XRP’s downward move was triggered by surging sell volume during peak trading hours, particularly between 15:00 and 16:00 UTC. During this period, trading volume more than doubled, pushing the price below the crucial $2.20 support zone and establishing resistance near $2.19.

The token briefly attempted recovery, reaching $2.179, but was swiftly rejected as sellers dominated the order book once again. A high-volume dip at 02:01 UTC pushed the token to a fresh intraday low of $2.162, confirming a lower low and sustaining the downtrend.

Technical Indicators Signal Bearish Continuation

Technical analysis suggests XRP remains in a descending channel, a bearish continuation pattern. The channel is forming on lower timeframes and indicates potential downside unless momentum shifts.

- Immediate resistance lies at $2.175–$2.20

- Support has formed at $2.147, where buyers have repeatedly stepped in

- Short-term stabilization is possible, but upside will likely remain capped unless bulls reclaim $2.20

Macroeconomic and Sentiment-Driven Headwinds

The decline in XRP price comes as part of a broader wave of risk-off sentiment sweeping across crypto markets. Contributing factors include:

- Global macro uncertainty, including U.S.-China trade tensions

- Conflicting central bank signals from major economies

- Negative impact from recent ETF rejections

- General weakness in risk-on assets, including altcoins

Despite XRP’s expanding global infrastructure — especially around Ripple’s upcoming RLUSD stablecoin and regulatory progress in Dubai and Singapore — these factors have done little to support short-term price action.

Outlook: Can XRP Hold $2.14 Support?

As of now, XRP trades narrowly around $2.164, with volume starting to taper off. This suggests the potential for short-term consolidation, but any further rejection from $2.20 could push the price toward the $2.10 level.

Until buyers reclaim key resistance, the path of least resistance remains to the downside. Investors and traders are advised to watch volume patterns closely and look for confirmation of trend reversal before entering long positions.

Summary

XRP has dropped 5% amid high-volume selling and bearish technical signals. The $2.20 level remains a major resistance, while $2.147 serves as critical support. Market sentiment continues to be shaped by macro uncertainty and weak ETF developments.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss