XRP Faces Strong Resistance Despite Elevated Trading Activity

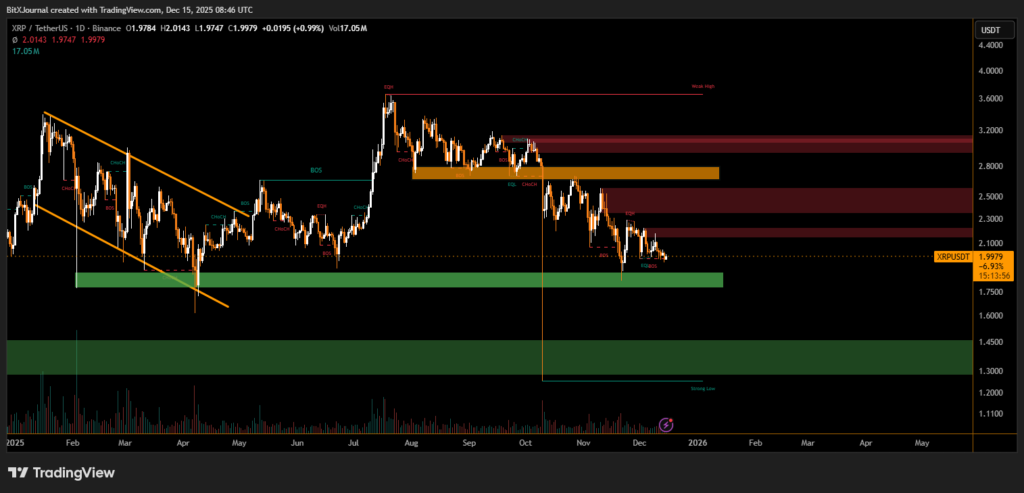

XRP is once again testing trader patience as the price fails to establish a sustained move above the psychologically important $2.00 level. The repeated rejection highlights a growing imbalance between bullish expectations and persistent selling pressure placing XRP at a near term inflection point.

Price action shows that XRP has now failed three consecutive attempts to clear the $2.00 resistance zone. Each rejection has been accompanied by elevated trading volume, signaling that sellers are actively defending this level. The most recent pullback occurred just below $2.01 reinforcing the importance of this price area as a technical ceiling.

From a structural perspective, XRP remains trapped below a broader resistance range formed after its earlier rally. Until this zone is reclaimed, upside momentum remains constrained.

Volume Signals Distribution, Not Accumulation

Although volume remains relatively high it has not translateed into sustained upward movement. Instead the data suggests distribution rather than accumulation, as rallies are consistently met with strong sell orders. This behavior explains why XRPs price action appears disconnected from broader market improvements and favorable institutional developments.

Short term indicators continue to point toward a neutral-to-bearish bias. As long as XRP trades below $2.01 on a daily closing basis, downside risks remain active. Immediate support is holding for now, but repeated resistance failures increase the probability of further consolidation or a deeper corrective move.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.