XRP Price Analysis

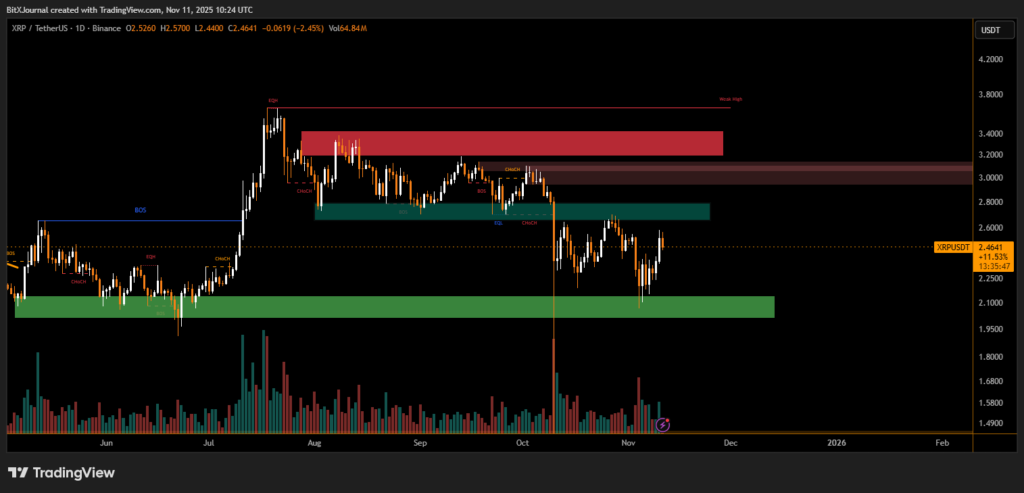

XRP extended its recent gains on Monday, surging over 11% as optimism around a potential XRP ETF continued to fuel bullish sentiment in the market. The token briefly tested the $2.57 resistance level before sellers stepped in, triggering a mild pullback toward $2.46. Despite the intraday rejection, buyers maintained control above the $2.52–$2.53 support area, signaling that short-term momentum remains intact.

The current structure shows XRP forming higher lows after bouncing strongly from the $2.10 demand zone, an area that previously acted as a consolidation base in late October. This sustained defense underscores increasing confidence among traders anticipating regulatory and institutional catalysts.

Technical Setup and Key Levels

Technically, XRP continues to trade within a bullish continuation structure, with visible liquidity zones around $2.60 and $2.80. The red resistance block between $2.57 and $2.65 remains the primary barrier to further upside. A daily close above this level could confirm a breakout toward the next target region near $3.00.

Volume analysis highlights renewed market activity, though analysts caution that the current surge may face short-term exhaustion. BitXJournal crypto market analyst noted, “The reaction around $2.57 shows that bulls are testing supply strength. A sustained push above $2.65 would likely signal institutional positioning ahead of possible ETF-related headlines.”

If XRP fails to break above resistance, traders expect the $2.30–$2.40 range to serve as a stabilizing zone for the next leg of consolidation. However, as long as the price holds above $2.10, the broader uptrend remains structurally sound.

In the near term, a decisive break above $2.65 could accelerate XRP’s next rally phase, with technical targets set toward the $3.00–$3.20 zone. Conversely, failure to sustain momentum above $2.50 could trigger mild retracement before a potential continuation higher.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.