Macroeconomic Tensions Trigger Crypto Sell-Off

XRP dropped as much as 6% over the last 24 hours, briefly hitting a low of $2.09 before stabilizing near $2.14, reflecting a broader crypto market correction. The downturn follows rising global trade tensions and a wave of forced liquidations that have rattled investor sentiment across digital asset markets.

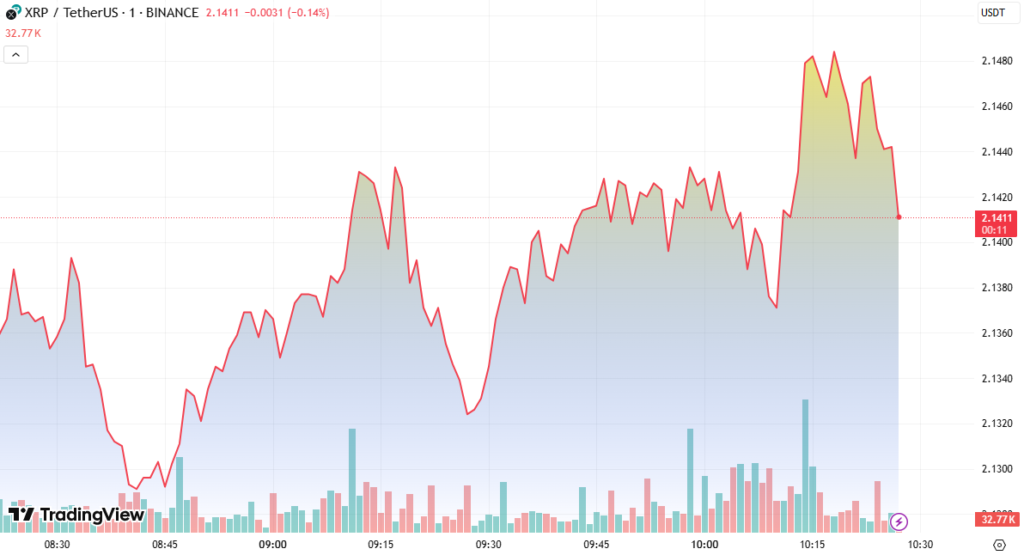

XRP’s price fell from $2.20 to $2.14, marking a 5.7% loss, while the total crypto market cap declined by 3.81% to $3.3 trillion.

The U.S. Court of International Trade’s decision to overturn Trump-era tariff suspensions reignited trade policy fears, adding fuel to an already cautious market environment.

Liquidations and Resistance Pressure XRP

Over $29.68 million in XRP long positions were liquidated during the decline, as traders adjusted their exposure amid heightened volatility.

Strong selling pressure was recorded at the $2.21 resistance level, particularly during high-volume hours at 16:00 and 22:00. On the downside, $2.11 emerged as a critical support level, where high-volume buying around 03:00 helped prevent further losses.

XRP’s price action displayed lower highs, signaling ongoing bearish sentiment. However, a higher-low pattern near $2.135 in the final hour indicated potential short-term stabilization.

Cross-Border Use Cases Continue to Expand

Despite market weakness, XRP adoption continues in enterprise sectors. China-based Webus International recently announced a plan to raise $300 million through non-equity financing, backed by XRP reserves. The goal is to integrate XRP for cross-border chauffeur payments, using on-chain records and a Web3 loyalty program.

The initiative includes renewed collaboration with Tongcheng Travel Holdings, utilizing the XRP Ledger for real-time driver payouts and international settlements.

Additionally, XRP’s issuer recently released a report on cross-border payment solutions, highlighting how blockchain can streamline the $31.6 trillion B2B market, projected to reach $50 trillion by 2032. The report noted that current payment rails remain slow, expensive, and opaque, while XRP-based solutions offer instant, transparent, and cost-effective alternatives.

Technical Analysis Summary

- 24h Price Drop: $2.20 → $2.14 (−5.7%)

- Price Range: $2.22 (high) to $2.09 (low), total range of $0.13 (5.9%)

- Resistance: $2.21 and $2.144–$2.145

- Support: $2.11 and short-term higher low at $2.135

- Closing Price: $2.137, indicating ongoing consolidation

Outlook Remains Cautious

As macroeconomic tensions persist and technical resistance levels hold firm, XRP traders are watching closely for a breakout above $2.145 or a breakdown below $2.11. Until momentum shifts decisively, market conditions remain uncertain and risk-sensitive.