Ripple-linked token breaks key resistance as Nasdaq certifies first XRP exchange-traded fund

The cryptocurrency market witnessed renewed enthusiasm today as XRP climbed more than 3%, reaching $2.49, following confirmation that the first U.S. spot XRP ETF will go live when the Nasdaq opens trading. The move marks a pivotal moment for Ripple’s native token, often seen as a bridge asset between traditional finance and blockchain networks.

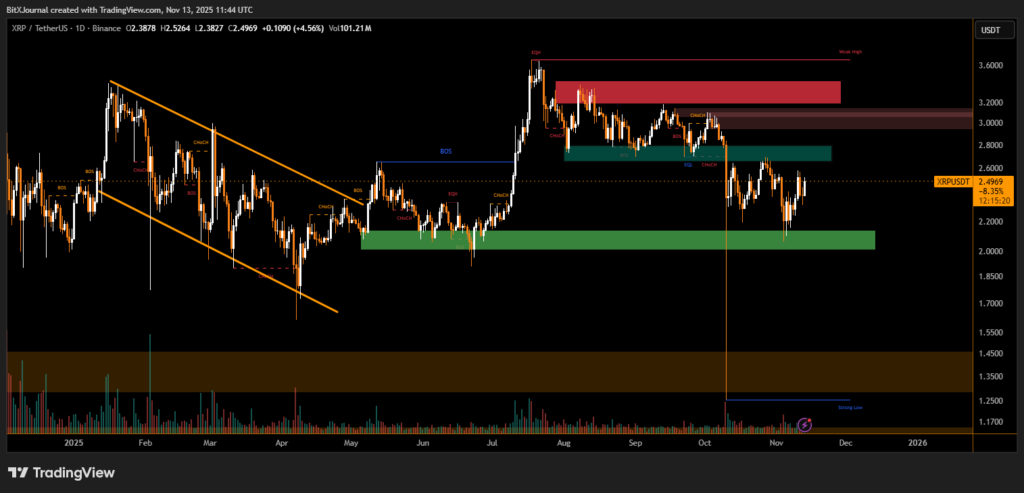

According to trading data, XRP’s breakout was accompanied by a 31% surge in volume, signaling growing institutional interest. The token rallied past a critical resistance near $2.45, as shown in recent technical setups, and is now testing higher liquidity zones around $2.60.

BitXJournal Market analysts say the ETF certification could serve as a turning point for XRP. “This approval puts XRP in the same league as Bitcoin and Ethereum in terms of market legitimacy,” noted BitXJournal digital asset strategist. “It signals that regulatory clarity around XRP is improving, and that could attract significant inflows from both retail and institutional investors.”

On the charts, XRP recently broke out of a descending channel that had defined price action since early 2025. The breakout confirmed a bullish structure shift (BOS), while the next area of resistance is projected between $2.80 and $3.00, followed by a major supply zone near $3.20. Key support remains around $2.10, where buyers previously defended the trend.

BitXJournal analyst added, “The ETF launch is more than symbolic — it provides a compliant gateway for U.S. investors to gain XRP exposure without dealing directly with crypto exchanges. If momentum holds, a retest of the $3.00 zone appears highly probable.”

As of mid-session Thursday, XRP trades at $2.49, consolidating above its short-term support and maintaining a bullish bias ahead of the ETF debut.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.