The XRP market is heating up, fueled by Ripple’s strategic moves toward regulatory integration, including a U.S. national bank license application and speculation around a potential XRP ETF. Despite short-term volatility, traders and analysts are eyeing a long-term price target of $10, supported by growing institutional interest and central bank digital currency (CBDC) initiatives.

XRP Holds Key Support as Price Consolidates

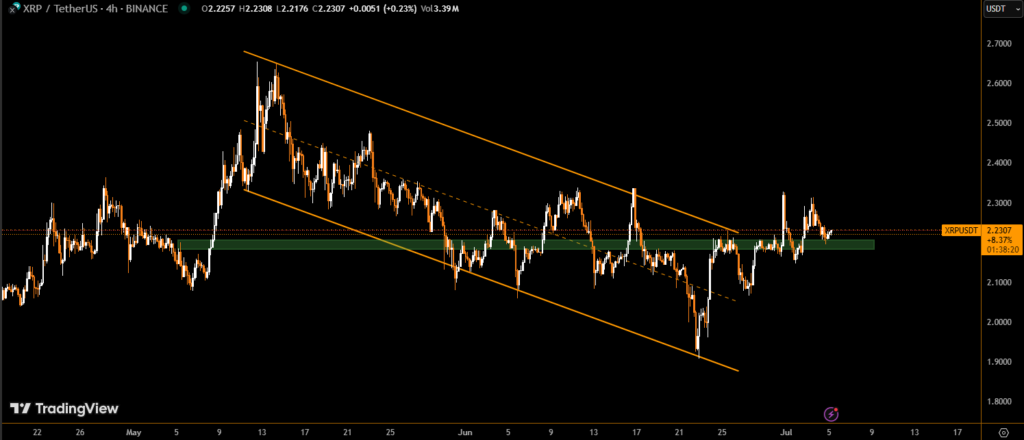

In the past 24 hours, XRP dipped 1.07%, falling from $2.243 to $2.219. However, it remains structurally bullish, forming higher lows above the crucial $2.20 support level. Traders see this as a consolidation phase following recent gains.

Strong buyer interest emerged at $2.209, with consistent defense during high-volume sell-offs, suggesting resilience despite broader market uncertainty.

Volume spikes of over 56 million units during July 4th–5th reflect heightened trading activity. A failed rally attempt at $2.230 signals ongoing caution, but technical patterns remain supportive of future upside moves.

Ripple’s U.S. Bank License and ETF Buzz Boost Sentiment

Ripple’s application for a U.S. banking license with the Office of the Comptroller of the Currency (OCC) and its separate bid for a Federal Reserve master account could mark a historic milestone for crypto integration into traditional finance.

Direct access to the Fed’s payment rails would position Ripple as a digital finance leader, enhancing XRP’s utility in global settlement systems.

Adding to the excitement, ETF speculation continues to drive long-term bullish sentiment. If approved, an XRP ETF could unlock institutional capital inflows, reinforcing the token’s market credibility and price potential.

XRP Positioned for CBDC Bridge Role

More than 50 countries are exploring XRP Ledger as infrastructure for cross-border CBDC payments, further strengthening the token’s value proposition. XRP’s speed, scalability, and low transaction costs make it a prime candidate for digital currency settlement solutions.

Analysts believe that with regulatory clarity and broader adoption, XRP could realistically reach the $10 mark in the coming market cycles.

Long-Term Outlook Remains Bullish

While XRP faces short-term resistance and macroeconomic headwinds, its foundational growth narrative is strengthening. From banking integration to CBDC infrastructure, Ripple’s progress is aligning XRP with the future of finance. Traders are watching closely — and if institutional momentum holds, the path to $10 may be more realistic than ever.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.