Price Holds Above Critical Demand While Major Supply Zones Limit Upside Momentum

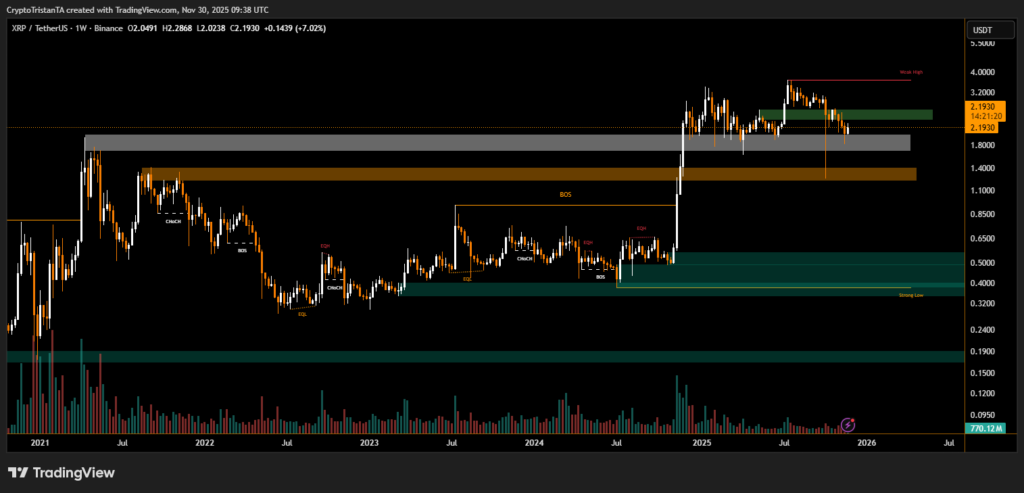

XRP’s weekly chart continues to offer a clear map of market structure, defined by a sequence of breaks of structure, equal highs, liquidity sweeps and major supply-and-demand zones. During the latest weekly session, XRP held above essential support despite encountering resistance at previously rejected zones. These technical boundaries remain central to understanding the asset’s next directional move.

XRP Market Structure and Long-Term Ranges

On the weekly timeframe, XRP has remained within a broad structural range stretching back to 2021. The market reveals several significant breaks of structure (BOS) and change-of-character (CHoCH) events that set the tone for medium-term trend shifts. The most recent BOS to the upside confirmed that buyers regained control after defending a deep demand region.

A major weak high sits above the current market, marking a level where liquidity may be targeted in future rallies. Meanwhile, the asset continues to hold above previously swept equal lows, indicating that market makers may have already tapped downside liquidity.

Key Supply Zones Limiting Upside

A prominent multi-year supply zone between approximately $2.70 and $3.40 is acting as the dominant ceiling. XRP’s recent candles show strong rejection wicks as price tested the lower boundary of this zone. This level remains the primary barrier preventing continuation toward higher-timeframe targets.

Below this region, a secondary supply area around $1.80 to $2.20 has played an important role, capping several weekly impulses and repeatedly flipping between support and resistance.

Demand Zones Supporting the Current Range

The market highlights significant demand levels between $1.10 and $1.40, as well as a deeper accumulation band near $0.40 to $0.60. These zones produced earlier BOS events and continue to support XRP’s broader bullish structure.

As long as XRP holds above the mid-range demand area, weekly momentum remains constructive.

XRP remains technically well-positioned as long as buyers defend current support. A decisive close above the lower supply band could open a path back toward the weak high. Failure to break this level, however, may return price toward the mid-range demand zone for another liquidity cycle.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.