New blueprint outlines a shift away from rigid fees, aiming to curb congestion and keep privacy-focused transactions affordable

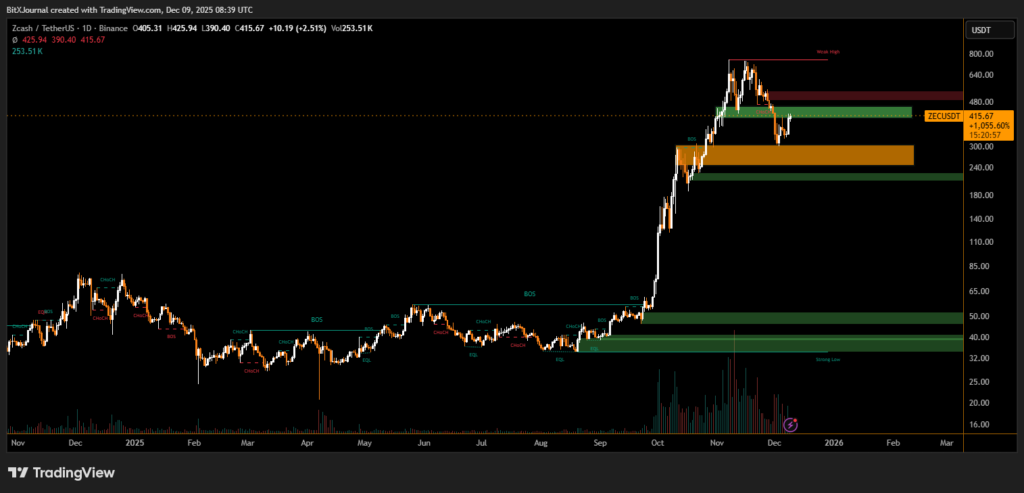

Zcash developers have unveiled a comprehensive plan to overhaul the network’s long-standing fee model, introducing a dynamic pricing system designed to prevent users from being priced out as activity increases. The proposal arrives as ZEC trades near yearly highs and network demand accelerates.

A new framework published by Shielded Labs outlines the first fully detailed roadmap for a dynamic fee market on Zcash. The initiative moves away from the network’s static fee structure originally set at 10,000 zatoshis and later lowered to 1,000 which “worked during low demand” but contributed to spam-driven congestion episodes that slowed wallet performance and overloaded the chain.

The earlier ZIP-317 upgrade introduced action-based accounting, where transaction components such as spends, outputs, JoinSplits and Orchard actions are treated as uniform “actions.” While this reduced exploitation risks, it still relied on predictable fees that failed to adjust with network stress.

With ZEC’s rising price, institutional interest and new retail inflows, developers say the system has become increasingly brittle. Some users have reported higher real-cost transactions, and edge-case scenarios show large sets of tiny transfers can cost double-digit ZEC to shield.

The new proposal introduces a stateless dynamic model grounded in “comparables” the median fee per action measured over the prior 50 blocks, supplemented with synthetic transactions to simulate consistent congestion. This median becomes the network’s standard fee, grouped into powers of ten to protect user anonymity. In high-demand periods, a priority lane opens at 10× the normal fee, giving users a way to compete for block space without redesigning core protocol mechanics.

The rollout would occur in phases: off-chain monitoring, wallet-level policy adjustments, and eventually a simple consensus change with expiration limits and fixed fee tiers. This avoids the complexity and fork risks associated with mechanisms like EIP-1559 while preserving Zcash’s privacy guarantees.

Developers are also exploring long-term heuristics, including using mining difficulty as a guide for USD-aligned fees. As the discussion unfolded, ZEC rose more than 12%, trading around $395 as markets reacted to the first major fee reform roadmap since ZIP-317.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.